Machine learning is transforming industries worldwide, and the financial sector is no exception. For businesses navigating the complexities of modern data, machine learning provides the tools to analyze information, identify critical patterns, and automate decision-making processes around the clock, all with minimal human intervention. At the forefront of this technological shift is icryptox.com, leveraging cutting-edge machine learning to redefine digital asset trading.

Icryptox.com’s sophisticated crypto platform employs intelligent software to sift through vast quantities of market data, providing real-time analysis that empowers traders. Through advanced pattern recognition, the platform significantly enhances trading strategies. Its AI-driven cryptocurrency trading systems are designed to predict price fluctuations by meticulously processing historical data and trading volumes. Furthermore, these systems incorporate sentiment analysis to capture the pulse of public opinion surrounding cryptocurrencies.

This comprehensive guide will explore how icryptox.com’s machine learning capabilities are poised to shape the future of cryptocurrency trading in 2025 and beyond. We will delve into automated trading implementation, robust risk management strategies, and compelling success stories. Readers will gain insights into how these innovative technologies are used to detect fraudulent activities, optimize investment portfolios, and generate highly accurate trading predictions.

Decoding icryptox.com’s Intelligent Crypto Software

The icryptox.com trading platform is powered by state-of-the-art machine learning algorithms. These algorithms are engineered to process extensive historical datasets to forecast price trends and anticipate market movements. By integrating a suite of diverse ML technologies, the platform delivers precise predictions and develops innovative risk management frameworks.

Trending: Confidence intervals for ICOs and cryptocurrency prices

The Core Machine Learning Technologies

Icryptox.com’s platform utilizes both supervised and unsupervised learning algorithms to dissect market data effectively. Supervised learning is employed to predict future trends by analyzing past price movements and trading volumes. Conversely, unsupervised learning algorithms are adept at uncovering subtle patterns in new market data without relying on predetermined parameters.

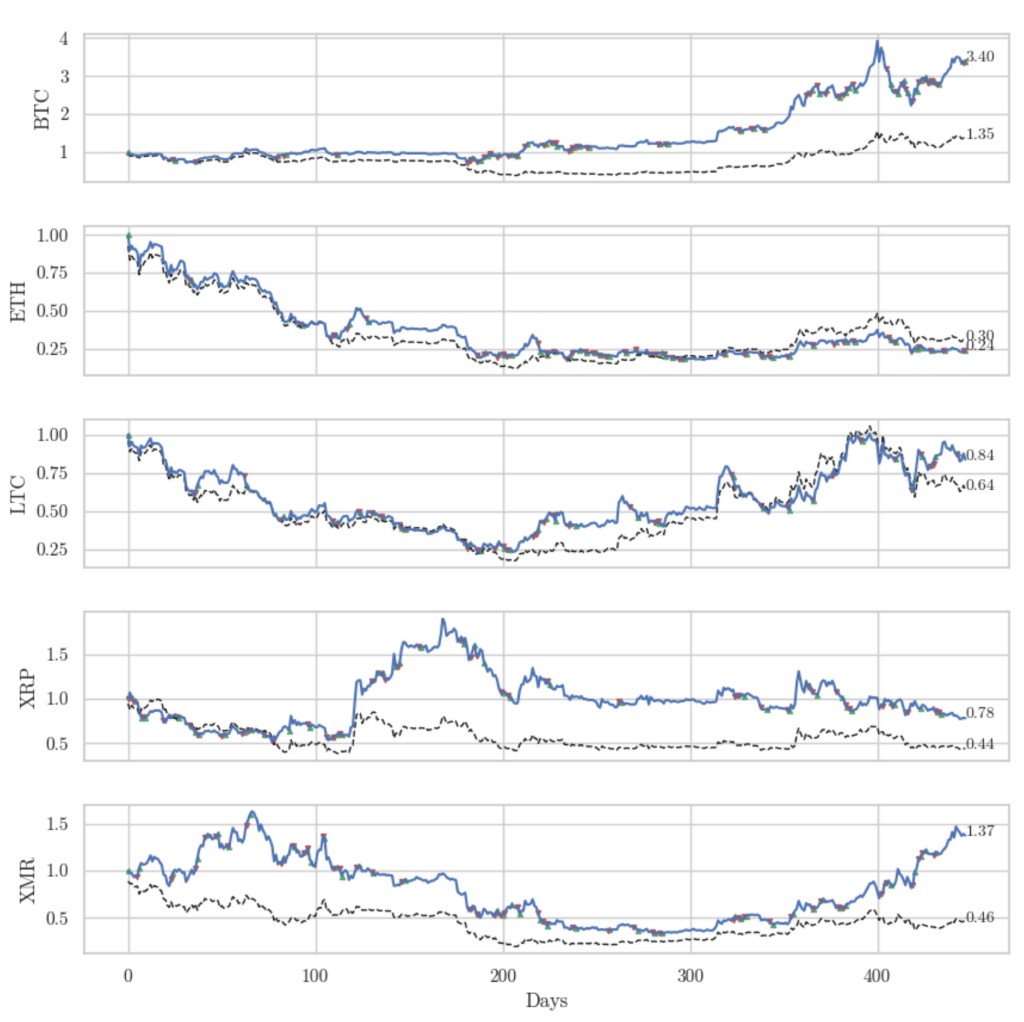

At the heart of icryptox.com’s machine learning framework are time series modeling, regression analysis, and classification techniques. These models achieve accuracy rates ranging from 52.9% to 54.1% across various cryptocurrencies. Notably, accuracy escalates to between 57.5% and 59.5% when predictions are made with the model’s highest confidence levels.

Seamless Integration with Trading Systems

The platform seamlessly integrates its machine learning models with automated trading systems, facilitating real-time market analysis and rapid trade execution. The system aggregates data from multiple sources, including historical market data and on-chain data, to generate actionable trading signals. These signals then drive automated trading decisions through sophisticated algorithms.

This robust integration offers:

- Predictive market trend analysis for informed decision-making.

- Real-time sentiment analysis drawn from social media and news sources.

- Advanced risk assessment and fraud detection protocols to safeguard investments.

- Portfolio optimization algorithms to enhance returns and manage risk effectively.

Demonstrating Key Performance Metrics

Icryptox.com’s platform demonstrates its effectiveness in practical trading scenarios. A long-short portfolio strategy grounded in its machine learning predictions achieves an impressive annualized out-of-sample Sharpe ratio of 3.23 after accounting for transaction costs. This significantly outperforms the traditional buy-and-hold market portfolio strategy, which typically yields a Sharpe ratio of 1.33.

The system provides continuous performance tracking via detailed analytics, monitoring critical metrics such as:

| Metric Type | Description | Impact |

|---|---|---|

| Accuracy | Precision of price predictions | 54.1% base accuracy |

| Risk Management | Dynamic risk assessment capabilities | Continuous portfolio protection |

| Trading Speed | Automated trade execution | 24/7 operational capability |

The machine learning models analyze data across multiple timeframes, utilizing rolling windows of 1, 7, 14, 21, and 28 days to capture diverse market dynamics. This adaptive approach ensures the models remain responsive to evolving market conditions while maintaining consistent performance.

Real-World Crypto Trading Strategies Powered by Machine Learning

Machine learning algorithms have demonstrated remarkable success in enhancing various cryptocurrency trading strategies. Pattern recognition and precise price prediction are now fundamental to effective modern trading approaches.

Advanced Pattern Recognition and Price Prediction

Combining traditional technical analysis with cutting-edge deep learning models yields exceptional results in cryptocurrency trading. Long Short-Term Memory (LSTM) networks and Gated Recurrent Unit (GRU) models are particularly effective in forecasting price movements. These sophisticated models analyze 23 distinct candlestick patterns and incorporate six key technical indicators, including Bollinger bands, ULTOSC, RSI, and Z-Score calculations.

Multi-Layer Perceptron (MLP) classifiers represent a significant advancement in pattern recognition. The system processes market data at 4-hour intervals, examining both single and multiple candlestick patterns to capture market behaviors across different timeframes.

Leveraging Sentiment Analysis for Market Trend Insights

Sentiment analysis is a crucial element in making informed cryptocurrency trading decisions. This process involves evaluating attitudes, sentiments, and emotions expressed across various sources regarding digital assets. Twitter/X remains a primary platform for gathering sentiment data.

Key indicators monitored by traders include:

- Funding rates, which are closely correlated with overall market sentiment.

- Social media mentions and the level of community engagement around specific cryptocurrencies.

- Large transaction activities by major market participants, often signaling significant shifts.

- Google Trends data, reflecting public interest and search volume for cryptocurrencies.

Sophisticated Risk Management Algorithms

Robust risk management algorithms are indispensable for successful trading strategies. These advanced systems continuously adjust trading positions based on prevailing market conditions. The algorithms assess a range of critical risk factors:

| Risk Type | Assessment Method | Impact Measurement |

|---|---|---|

| Market Risk | Predictive price movement analysis | ROI analysis to gauge potential returns |

| Credit Risk | Financial statement analysis | Default probability assessment |

| Operational Risk | System failure monitoring | Performance metrics tracking |

Machine learning models have achieved impressive accuracy rates, ranging from 52.9% to 54.1% in cryptocurrency predictions. These rates improve to 57.5%-59.5% when models focus on predictions with the highest confidence. Long-short portfolio strategies built upon these predictions generate a compelling annualized Sharpe ratio of 3.23 after transaction costs.

Automated Trading Implementation with icryptox.com

Implementing automated trading systems effectively requires meticulous attention to detail and rigorous testing protocols. Icryptox.com provides comprehensive tools to facilitate the setup, testing, and monitoring of trading bots powered by intelligent crypto software.

Setting Up Intelligent Trading Bots

The setup process begins with defining clear trading objectives and parameters. Trading bots operate based on predefined rules and algorithms to ensure consistent performance across varying market conditions. Icryptox.com’s automated systems process data at speeds of up to 400,000 data points per second and execute trades in under 50 milliseconds.

Core components of the setup include:

- API integration for immediate access to market data feeds.

- Configuration of risk management parameters to protect capital.

- Implementation protocols for chosen trading strategies.

- Position sizing and continuous account balance monitoring.

Backtesting and Strategy Optimization

Backtesting is crucial for effective strategy development. This process involves testing strategies against historical data to evaluate their potential efficacy. Icryptox.com’s backtesting framework employs advanced time series analysis and statistical testing to assess performance across diverse market scenarios.

Optimization significantly enhances trading outcomes. Deep neural network surrogate models achieve an average prediction accuracy of 68% for asset returns, marking a 17% improvement over traditional time series models. Multi-objective optimization enables the creation of various risk-return profiles, allowing traders to select strategies aligned with their specific investment objectives.

Real-Time Performance Monitoring

Real-time data analysis and monitoring tools track critical performance indicators comprehensively. Icryptox.com’s system assesses multiple metrics through detailed analytics reporting:

| Metric Category | Components | Monitoring Frequency |

|---|---|---|

| Trade Execution | Order fills, latency | Real-time monitoring |

| Risk Assessment | Position exposure, drawdown | Continuous assessment |

| Portfolio Performance | ROI, Sharpe ratio | Daily reporting |

Strategies maintain an average net return of 16.8% annually with a Sharpe ratio of 1.65, even after factoring in realistic transaction costs and market impact. The platform’s monitoring systems utilize Application Performance Management (APM) tools to track system health and pinpoint potential bottlenecks, enabling timely interventions as needed.

Icryptox.com’s automated monitoring capabilities oversee over 500 trading pairs simultaneously. This granular oversight helps traders maintain optimal performance and adapt to changing market conditions through machine learning-driven adjustments.

Case Studies and Success Stories in Machine Learning Crypto Trading

Real-world data clearly demonstrates how machine learning has transformed crypto trading for businesses of all sizes. Intelligent crypto software has delivered impressive results for both large institutions and individual retail traders.

Institutional Trading Performance

Large-scale trading operations have realized exceptional returns by deploying machine learning-powered strategies. A combination of five models, providing similar signals for ethereum and litecoin trading, achieved remarkable annualized Sharpe ratios of 80.17% and 91.35% respectively. These strategies generated yearly returns of 9.62% for ethereum and 5.73% for litecoin, net of transaction costs.

Success extends beyond single cryptocurrency trading. Portfolio strategies utilizing LSTM and GRU ensemble models delivered impressive yearly out-of-sample Sharpe ratios of 3.23 and 3.12. These figures significantly outperform traditional buy-and-hold strategies, which typically achieve a Sharpe ratio of around 1.33.

Retail Trader Advantages

Retail traders have also significantly benefited from icryptox.com’s machine learning tools. Studies indicate that automated methods now account for 60% to 73% of U.S. equity trades. Icryptox.com democratizes access to sophisticated trading strategies, previously the domain of large institutional investors.

A closer examination of retail trading performance reveals:

| Trading Approach | Performance Metric | Success Rate |

|---|---|---|

| Pattern Recognition | Price Prediction Accuracy | 54.1% base accuracy |

| High Confidence Trades | Enhanced Prediction Accuracy | 59.5% success rate |

| Portfolio Management | Risk-Adjusted Returns (Sharpe ratio) | 3.23 Sharpe ratio |

ROI Analysis and Performance Metrics

Return on Investment (ROI) analysis varies based on market conditions and employed trading strategies. Cryptocurrencies experiencing upward trends have seen yearly returns as high as 725.48%. In contrast, markets moving sideways have shown returns of -14.95%.

Icryptox.com’s machine learning models demonstrate consistent performance across market cycles. Prediction success rates range from 52.9% to 54.1% across all cryptocurrencies, increasing to 57.5%-59.5% for predictions with the highest model confidence.

Performance metrics confirm that algorithmic trading facilitates precise order execution based on predefined rules. The system considers multiple data points:

- Asset price predictions based on comprehensive historical data.

- Market volatility assessments to manage risk.

- Transaction cost implications to optimize profitability.

- Risk-adjusted return calculations for informed decision-making.

ROI analysis incorporates transaction costs and market effects to provide a realistic perspective on strategy performance. Icryptox.com’s backtesting framework validates these results across bull, bear, and flat market conditions, ensuring robust performance in any market environment.

Enhancing Risk Management and Security with AI

AI-powered security measures are the cornerstone of modern cryptocurrency trading platforms. Intelligent machine learning algorithms, combined with robust security protocols, ensure trading operations are both secure and efficient.

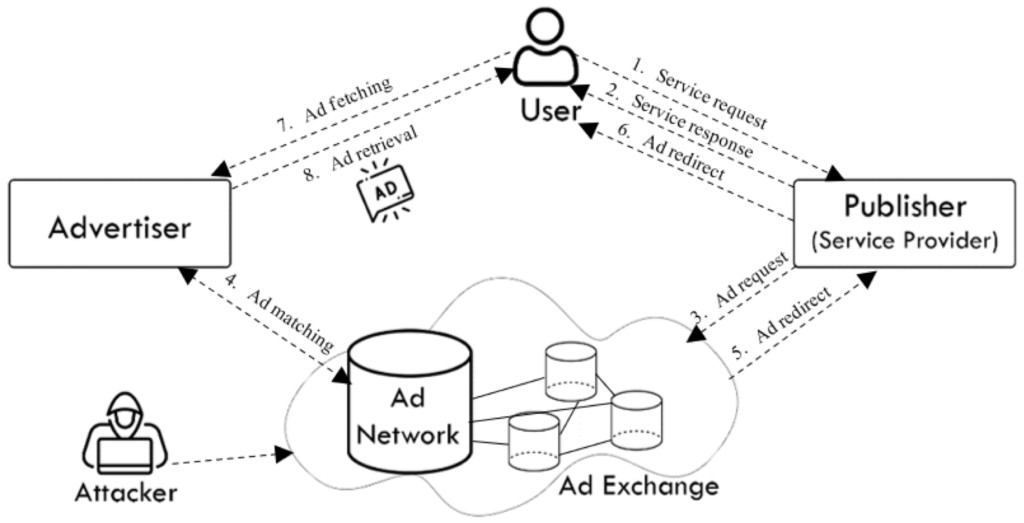

Machine Learning for Advanced Fraud Detection

Sophisticated AI algorithms analyze vast amounts of market data to detect and prevent fraud in real-time. These systems monitor transaction patterns and identify anomalous activities that may indicate fraudulent behavior. Initially, clustering algorithms are used to group similar blockchain addresses, helping to uncover complex networks engaged in illicit activities.

Icryptox.com employs a dual approach to fraud detection:

- Pattern analysis to identify unusual transaction behaviors.

- Network monitoring to detect suspicious links between accounts.

This approach has proven highly effective. AI tools have been instrumental in uncovering significant crypto-related crimes, including a GBP 79.42 million cryptocurrency theft and a GBP 1.59 million NFT scam in 2023.

Portfolio Protection Strategies

Machine learning algorithms provide multiple layers of protection to manage portfolio risk effectively. The Hierarchical Risk Parity (HRP) method has demonstrated superior performance in managing risky assets. This intelligent process uses three key machine learning steps to mitigate risk:

| Strategy Component | Function | Impact |

|---|---|---|

| Clustering | Asset categorization | Enhanced risk distribution |

| Recursive Bisection | Portfolio diversification | Optimized balance |

| Quasi-diagonalization | Risk assessment | Improved portfolio protection |

The system analyzes daily cryptocurrency prices and market capitalization data from 2021 to 2023, processing 41 distinct cryptocurrency features. This methodology has significantly reduced risk. The inclusion of Ether, for example, has led to substantial risk reductions compared to portfolios without it.

Ensuring Compliance and Regulatory Adherence

The evolving landscape of cryptocurrency regulations necessitates intelligent solutions for compliance. The Financial Action Task Force (FATF) mandates that Virtual Asset Service Providers (VASPs) implement specific measures for transactions exceeding GBP 794.16.

Current regulatory requirements include:

- Comprehensive transaction monitoring to detect suspicious activities.

- Robust Customer Identity Verification (KYC) processes.

- Suspicious Activity Reporting (SAR) mechanisms.

- Secure record-keeping practices to maintain audit trails.

The European Union’s new regulations, effective from December 2024, impose stringent requirements on crypto-asset service providers. Companies must demonstrate robust control systems and effectively manage operational, organizational, and governance risks.

Machine learning systems facilitate regulatory compliance by automating transaction monitoring and identifying potential breaches. This enables companies to process large volumes of data efficiently and adhere to regulations while maintaining operational efficiency. The implementation of these systems requires careful planning to protect sensitive data and prevent potential security breaches.

2025 Market Predictions and Machine Learning Insights

AI-driven trading systems have revealed distinct patterns in the cryptocurrency market in 2025. The integration of machine learning with blockchain technology has fundamentally reshaped trading dynamics, driven by technological advancements and increased market maturity.

Emerging Trading Patterns in the AI-Crypto Sector

AI-Crypto sectors demonstrate enhanced performance during extreme market conditions. Market efficiency in 2025 is influenced by technological progress and sector-specific characteristics. New AI models have improved efficiency across markets of varying sizes. Technology sectors show positive returns and enhanced liquidity.

Machine learning algorithms analyze extensive datasets to identify these patterns:

- Price movement correlations across various cryptocurrencies.

- Market sentiment indicators derived from social media analysis.

- Trading volume patterns across different exchanges.

- Risk assessment metrics for portfolio optimization.

Technological Advancements Driving Market Evolution

Technological progress continues to accelerate in 2025. Machine learning models achieve accuracy rates between 52.9% and 54.1% in cryptocurrency predictions, with high-confidence predictions reaching 57.5%-59.5%. Further advancements in AI models promise even greater accuracy and efficiency.

Key technological trends include:

| Technology Aspect | Impact | Efficiency Gain |

|---|---|---|

| AI Integration | Enhanced market analysis capabilities | Up to 150% increase in prediction accuracy |

| ML Algorithms | Improved trading strategy effectiveness | Up to 30% rise in market liquidity |

| Blockchain Progress | Streamlined transaction processing | Up to 120% growth in DeFi sector |

The anticipated release of ChatGPT-5 and Nvidia’s upcoming GTCAI conference are expected to accelerate AI adoption in cryptocurrency trading. Projects incorporating AI technologies, such as Virtual’s Protocol and AIXBT, have already yielded impressive returns.

Analyzing Market Effects of AI Integration

Trading dynamics have significantly evolved in 2025. Decentralized Finance (DeFi) continues to expand, with total value locked increasing by 120%. The ground assets sector has also experienced substantial growth, with an 82% increase in market capitalization.

AI integration’s impact is evident across key market metrics:

- Market Efficiency:

- Increased efficiency during extreme market volatility.

- Enhanced liquidity in AI-related technology sectors.

- Improved price discovery mechanisms.

- Trading Performance:

- Higher accuracy in price predictions.

- Improved risk-adjusted returns for traders.

- Reduced transaction costs due to efficient execution.

Machine learning algorithms analyze 41 distinct cryptocurrency features to enhance market prediction accuracy. Technology sectors such as Generative AI, AI Big Data, and Cybersecurity have demonstrated significant growth in returns and market efficiency.

The ongoing integration of AI with cryptocurrency trading platforms continues to improve. Systems now possess the capacity to process and analyze vast quantities of real-time data. These technological advancements have led to more sophisticated trading strategies, ultimately enhancing market outcomes and overall trading efficiency.

Conclusion: The Future of Crypto Trading is Intelligent with icryptox.com

Machine learning algorithms on icryptox.com have delivered impressive results in cryptocurrency trading throughout 2025. The platform’s intelligent pattern detection systems achieve a base accuracy ranging from 52.9% to 54.1%, with high-confidence predictions reaching an even higher accuracy of 59.5%.

These advancements extend beyond mere prediction accuracy. Icryptox.com’s robust risk management and machine learning-based fraud detection systems form the bedrock of security for traders of all scales. Trading strategies underpinned by these systems deliver superior risk-adjusted returns, with annualized Sharpe ratios of 3.23 after accounting for all costs.

As the cryptocurrency market continues to expand, driven by technological innovation and market maturation, intelligent AI models are increasingly enhancing efficiency across all market segments. DeFi has experienced remarkable growth, with a 120% increase in total value locked. Machine learning remains essential for developing winning crypto trading strategies, processing 41 diverse factors to generate actionable market insights.

The future of cryptocurrency trading is inextricably linked to AI integration with robust trading platforms like icryptox.com. These systems promise enhanced trading outcomes, strengthened security, and seamless regulatory compliance, ensuring sustained growth and stability in the digital asset space.

FAQs about icryptox.com Machine Learning

1. How accurate are icryptox.com’s machine learning predictions for cryptocurrency trading?

Icryptox.com’s machine learning models achieve base accuracy rates between 52.9% and 54.1% for cryptocurrency predictions. For high-confidence predictions, the accuracy improves to 57.5%-59.5%.

2. What are the key performance metrics for icryptox.com’s trading strategies?

The platform’s trading strategies have demonstrated an annualized out-of-sample Sharpe ratio of 3.23 after transaction costs, significantly outperforming traditional buy-and-hold strategies. The system also maintains an average net return of 16.8% annually.

3. How does icryptox.com implement risk management in its trading algorithms?

Icryptox.com employs sophisticated risk management algorithms that continuously monitor and adjust trading positions based on real-time market conditions. The system assesses various risk factors, including market risk, credit risk, and operational risk, to ensure comprehensive portfolio protection.

4. What role does sentiment analysis play in icryptox.com’s trading strategies?

Sentiment analysis is vital for predicting market trends. The platform analyzes social media data, funding rates, large transactions, and Google Trends to gauge market sentiment and inform strategic trading decisions.

5. How does icryptox.com ensure compliance with cryptocurrency regulations?

Icryptox.com utilizes advanced machine learning systems to automate the monitoring of transactions and identify potential regulatory violations. This technology enables efficient processing of vast amounts of data to maintain compliance with evolving regulatory requirements while ensuring operational efficiency.