Are Stocks Hard To Learn? Embarking on the journey of stock investing can seem daunting, but LEARNS.EDU.VN is here to guide you through the process, making it accessible and understandable. Understanding stock markets, investment strategies, and financial analysis doesn’t have to be a mystery. This guide will break down complex concepts, offering clear explanations and actionable steps to help you succeed. We will explore practical strategies, risk management, and ways to stay informed.

1. Demystifying Stock Trading: An Introduction

Stock trading involves buying and selling shares of publicly traded companies. These shares represent ownership in a company, and their prices fluctuate based on market demand and company performance.

1.1. The Fundamentals of Stock Trading

Understanding the basics is the first step. When you trade stocks, you’re essentially participating in a marketplace where prices are determined by supply and demand. If more people want to buy a stock than sell it, the price goes up, and vice versa. Familiar stocks include Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Google (GOOGL).

1.2. Key Concepts for Beginners

- Shares: Units of ownership in a company.

- Market Capitalization: The total value of a company’s outstanding shares.

- Dividends: Payments made by a company to its shareholders, typically from profits.

- Volatility: The degree to which a stock’s price fluctuates.

1.3. Why Learn Stock Trading?

Learning to trade stocks can provide numerous benefits:

- Potential for Wealth Creation: Stocks have historically provided higher returns than other asset classes like bonds or savings accounts.

- Financial Independence: Understanding the stock market empowers you to make informed decisions about your financial future.

- Diversification: Stocks can be a key component of a diversified investment portfolio.

2. Ten Essential Steps to Begin Your Stock Trading Journey

These steps provide a structured approach to learning stock trading, ensuring you build a strong foundation.

2.1. Opening a Brokerage Account

To trade stocks, you’ll need an online broker. These platforms allow you to buy and sell stocks, and they compete for your business by offering various features and pricing structures.

2.1.1. Choosing the Right Broker

When selecting a broker, consider factors such as:

- Fees: Look for low or no commission fees.

- Platform: Ensure the platform is user-friendly and offers the tools you need.

- Educational Resources: Beginners benefit from brokers that provide robust educational content.

- Customer Service: Reliable customer support is essential.

Fidelity, Schwab, E*TRADE, and Merrill Edge are excellent choices for beginners due to their comprehensive educational resources. Refer to LEARNS.EDU.VN’s guide to the Best Online Brokerage Accounts for a detailed comparison.

2.1.2. Account Types

- Individual Brokerage Account: A standard account for investing.

- Retirement Account (IRA): Offers tax advantages for retirement savings.

- Custodial Account: For minors, managed by an adult until the minor reaches a certain age.

2.2. Monitoring Stock Market Trends

Staying informed about market trends is crucial. Reputable news sources can provide valuable insights into economic trends and market analysis.

2.2.1. Reliable News Sources

- MarketWatch: Offers comprehensive market news and analysis.

- The Wall Street Journal: Provides in-depth coverage of financial markets and business news.

- Yahoo Finance: Offers stock quotes, charts, and news headlines.

2.2.2. Television and Podcasts

- CNBC: A beginner-friendly channel providing real-time market updates.

- Bloomberg: Geared towards professionals, offering advanced financial news and analysis.

- Financial Podcasts: Provide expert insights and discussions on market trends.

Remember to critically evaluate the information you receive. Focus on understanding the reasoning behind investment recommendations rather than blindly following them.

2.3. Seeking Guidance from a Mentor

A mentor can provide invaluable support and guidance as you navigate the stock market.

2.3.1. Finding a Mentor

- Family Members: Individuals with investing experience.

- Friends or Co-workers: Those with a fundamental understanding of the stock market.

- Professors: Educators with expertise in finance.

2.3.2. The Role of a Mentor

A good mentor will:

- Answer your questions.

- Offer helpful resources.

- Provide encouragement and support.

2.4. Studying Successful Investors

Learning from the strategies and experiences of successful investors can provide perspective and inspiration.

2.4.1. Influential Investors

- Warren Buffett: Known for his value investing approach.

- Jesse Livermore: A legendary trader known for his insights into market psychology.

- Benjamin Graham: The father of value investing.

- Peter Lynch: Famous for his “invest in what you know” strategy.

2.4.2. Key Lessons

- Value Investing: Identifying undervalued companies with strong fundamentals.

- Risk Management: Implementing strategies to protect your capital.

- Long-Term Perspective: Focusing on long-term growth rather than short-term gains.

2.5. Reading Books on Stock Trading

Books offer a wealth of knowledge and are a cost-effective way to learn about stock trading.

2.5.1. Recommended Books

- “The Intelligent Investor” by Benjamin Graham: A classic guide to value investing.

- “How to Make Money in Stocks” by William O’Neil: Introduces the CANSLIM trading system.

- “One Up On Wall Street” by Peter Lynch: Emphasizes investing in companies you understand.

You can find more recommendations on LEARNS.EDU.VN’s list of great stock trading books.

2.5.2. Key Concepts

- Fundamental Analysis: Evaluating a company’s financial health.

- Technical Analysis: Using charts and patterns to predict future price movements.

- Market Psychology: Understanding how emotions influence market behavior.

2.6. Exploring Articles and Podcasts

Educational websites and podcasts offer valuable insights and analysis of the stock market.

2.6.1. Online Resources

- LEARNS.EDU.VN: Provides comprehensive guides and articles on investing.

- Howard Marks’ Memos: Insights from the billionaire investor at Oaktree Capital.

- Investopedia: Offers definitions and explanations of financial terms and concepts.

2.6.2. Benefits of Online Resources

- Up-to-Date Information: Stay informed about current market trends and news.

- Diverse Perspectives: Gain insights from various experts and analysts.

- Convenience: Access information anytime, anywhere.

2.7. Considering Paid Subscriptions (With Caution)

Some paid subscription services offer valuable research and analysis, but it’s essential to be selective.

2.7.1. Reputable Subscriptions

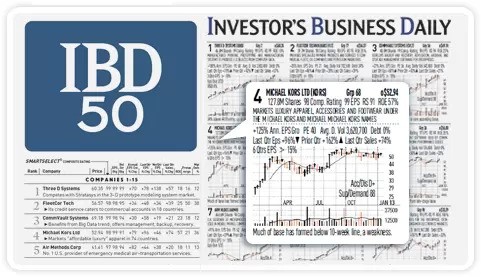

- Investor’s Business Daily: Offers research and analysis based on the CANSLIM system.

- The Wall Street Journal: Provides in-depth financial news and analysis.

2.7.2. Avoiding Scams

Be wary of subscriptions promoted by individual traders promising guaranteed returns. Many of these are scams or ineffective. As highlighted in LEARNS.EDU.VN’s article 10 Reasons Why I Quit Day Trading, it’s crucial to be skeptical of such claims.

2.8. Exploring Seminars, Online Courses, or Live Classes (With Caution)

Seminars and classes can provide valuable insights, but they can also be expensive and overhyped.

2.8.1. Reputable Seminars

- Will O’Neil Workshops: Focus on the CANSLIM investing strategy.

- Dan Zanger Seminars: Cover technical analysis and trading techniques.

- Mark Minervini Workshops: Emphasize momentum trading and risk management.

2.8.2. Red Flags

- High Costs: Be wary of expensive courses promising quick riches.

- Aggressive Sales Tactics: Watch out for high-pressure sales pitches.

- Unrealistic Promises: Be skeptical of guaranteed results.

Refer to LEARNS.EDU.VN’s article Why I Quit Day Trading for a cautionary perspective.

2.9. Practicing with a Simulator and Trading First Shares

Once you have a brokerage account, start with a small amount of capital and consider using a stock simulator.

2.9.1. Setting up a Broker Account

Ensure that your online broker account is set up correctly and linked to your bank account.

2.9.2. Virtual Trading

Use a stock simulator to practice buying and selling stocks without risking real money. Brokers like E*TRADE, Webull, and TradeStation offer paper trading accounts.

2.9.3. Gradual Transition

Once comfortable, start trading with small amounts. Some brokers allow buying fractional shares, enabling you to invest with as little as $5.

2.9.4. Managing Risk

A common mistake is investing too much too soon. As a rule of thumb, never risk more than five percent of your trading capital in one trade.

2.10. Following Warren Buffett’s Buy and Hold Advice

Consider a long-term buy-and-hold strategy, particularly for beginners.

2.10.1. The Buy and Hold Strategy

Warren Buffett recommends buying a diversified index fund and holding it for many years, rather than trying to actively trade the market.

2.10.2. Benefits of Index Funds

- Diversification: Spreads risk across a wide range of stocks.

- Low Cost: Index funds typically have low expense ratios.

- Simplicity: Requires minimal effort and monitoring.

Further information can be found in LEARNS.EDU.VN’s guide on how to invest.

3. Mastering Trading Strategies: Beyond the Basics

Once you’re comfortable with the fundamentals, explore different trading strategies to find what works best for you.

3.1. Buy and Hold Strategy

This strategy involves buying shares and holding them for years, focusing on long-term growth.

3.1.1. Advantages

- Simplicity: Requires minimal effort and monitoring.

- Tax Efficiency: Reduces capital gains taxes due to infrequent trading.

- Compounding: Allows your investments to grow over time.

3.1.2. Disadvantages

- Missed Opportunities: May miss out on short-term trading opportunities.

- Market Downturns: Can be challenging during bear markets.

3.2. Day Trading

Day trading involves buying and selling shares within the same day, aiming to profit from short-term price movements.

3.2.1. Advantages

- Potential for Quick Profits: Can generate profits in a short amount of time.

- No Overnight Risk: Avoids the risk of overnight market movements.

3.2.2. Disadvantages

- High Risk: Requires significant capital and expertise.

- Time-Consuming: Demands constant monitoring of the market.

- High Costs: Frequent trading can lead to high commission and tax expenses.

3.3. Passive Investing

Passive investing involves buying and holding the entire stock market through index funds or ETFs.

3.3.1. Advantages

- Diversification: Reduces risk by spreading investments across a wide range of stocks.

- Low Cost: Index funds and ETFs typically have low expense ratios.

- Simplicity: Requires minimal effort and monitoring.

3.3.2. Disadvantages

- Market Returns: Returns are limited to the overall market performance.

- Lack of Control: No ability to select individual stocks or adjust allocations.

3.4. Momentum Trading

Momentum trading involves buying stocks that are trending upwards and selling stocks that are trending downwards.

3.4.1. Advantages

- Potential for High Returns: Can generate significant profits during strong trends.

- Clear Entry and Exit Points: Uses technical indicators to identify trading signals.

3.4.2. Disadvantages

- False Signals: Can be prone to false signals and whipsaws.

- Requires Technical Analysis: Requires expertise in technical analysis and chart patterns.

3.5. Swing Trading

Swing trading involves holding stocks for a few days to a few weeks, aiming to profit from short-term price swings.

3.5.1. Advantages

- Moderate Risk: Offers a balance between risk and reward.

- Less Time-Consuming: Requires less monitoring than day trading.

3.5.2. Disadvantages

- Requires Technical Analysis: Requires knowledge of technical analysis and chart patterns.

- Overnight Risk: Subject to overnight market movements.

3.6. Penny Stock Trading

Penny stock trading involves buying shares of small companies that trade for less than $5 a share.

3.6.1. Advantages

- Potential for High Returns: Can generate significant profits if the stock price increases.

3.6.2. Disadvantages

- High Risk: Penny stocks are highly volatile and prone to scams.

- Limited Liquidity: Can be difficult to buy or sell shares.

4. ETFs and Mutual Funds: Diversification Simplified

ETFs (exchange-traded funds) and mutual funds are investment vehicles that hold a collection of stocks or bonds, providing instant diversification.

4.1. What are ETFs?

ETFs trade like stocks and fluctuate in price depending on supply and demand.

4.2. What are mutual funds?

Mutual funds are priced each day after the market closes, so everyone pays the same price.

4.3. Key Differences

| Feature | ETF | Mutual Fund |

|---|---|---|

| Trading | Traded throughout the day like stocks | Priced once a day after market close |

| Minimum Investment | Typically lower | Typically higher |

| Expense Ratios | Generally lower | Can vary; some are higher, some are lower |

| Tax Efficiency | Generally more tax-efficient | Can generate more taxable events |

4.4. Examples

- S&P 500 ETF (SPY): Tracks the performance of the S&P 500 index.

- Vanguard 500 Index Fund Admiral Shares (VFIAX): A mutual fund that tracks the S&P 500 index.

5. Learning from Famous Stock Traders

Studying the strategies and philosophies of successful traders can provide valuable insights and inspiration.

5.1. William O’Neil

William O’Neil is the founder of CANSLIM investing and Investor’s Business Daily.

5.1.1. Key Tips

- Be prepared to take small losses.

- Persistence is key.

- Don’t get emotionally involved.

- Follow a set of buying and selling rules.

- Concentrate on a few high-quality stocks.

- Always do a post-analysis of your trades.

5.2. Jesse Livermore

Jesse Livermore was a legendary trader known for his insights into market psychology.

5.2.1. Key Tips

- Cut your losses quickly.

- Confirm your judgments before going all in.

- Watch leading stocks for the best action.

- Let profits ride until price action dictates otherwise.

- Buy all-time new highs.

- Use pivot points to determine trends.

- Control your emotions.

5.3. John Paulson

John Paulson is a hedge fund manager known for his successful bets against the housing market.

5.3.1. Key Tips

- Don’t rely on experts; be skeptical.

- Always have an exit strategy.

- Educate yourself on new investment vehicles.

- Don’t underestimate insurance (such as put options).

- Experience counts.

- Don’t fall in love with any single investment.

- Don’t risk too much on any single trade; diversify risk.

6. Practical Stock Trading Tips for Success

These tips can help you navigate the stock market more effectively.

6.1. Think Win-Win

Consider selling half of your winning position and holding the rest with a stop-loss order.

6.2. Set Strict Rules

Establish rules to help you stay disciplined and avoid emotional decisions.

6.3. Know Earnings Dates

Always know when your stock holdings are posting earnings to avoid surprises.

7. Addressing Common Questions About Learning Stock Trading

Here are some frequently asked questions to help you clarify your understanding.

7.1. Can you teach yourself how to trade?

Yes, you can teach yourself how to trade by reading books, investing a small amount of money, and using free educational materials.

7.2. Is trading easy to learn?

Trading can be easy to do, but whether it’s easy to learn depends on your ability to spot patterns, the style of trading you choose, and your curiosity about how markets work.

7.3. What is the best free way to learn stock trading?

The best free way is to open a broker account and trade a virtual portfolio, also called “paper trading.”

7.4. Can I start trading stocks with $100?

Yes, you can start trading with $100 or less, thanks to fractional shares.

7.5. Which stock trading site is best for beginners?

Fidelity is a great choice for beginners due to its user-friendly platform, educational resources, and fractional shares.

7.6. Can you get rich by trading stocks?

Yes, but it’s more likely you’ll become richer from patiently holding a diversified portfolio of quality stocks for a long time.

8. Final Thoughts: Embrace the Journey

Investing is a lifelong game. Start with a small amount, keep it simple, and learn from every trade you make. If you find yourself emotionally charged, consider passively investing in the overall market with an index fund.

Learning to trade stocks is a journey that requires patience, dedication, and a willingness to learn. By following the steps outlined in this guide, you can build a solid foundation and increase your chances of success.

Ready to dive deeper? Explore LEARNS.EDU.VN for more detailed articles, courses, and resources to enhance your stock trading knowledge and skills. Don’t miss out on the opportunity to unlock your financial potential!

9. Discover More with LEARNS.EDU.VN

At LEARNS.EDU.VN, we understand the challenges faced by learners of all ages and backgrounds. Whether you’re a student seeking academic support, a professional aiming to upskill, or someone eager to explore a new hobby, our platform is designed to cater to your unique needs.

9.1. Personalized Learning Paths

Our website offers personalized learning paths tailored to your specific goals and interests. Whether you’re looking to master the basics of stock trading or delve into advanced investment strategies, our structured courses and resources will guide you every step of the way.

9.2. Expert Guidance and Support

LEARNS.EDU.VN connects you with experienced educators and industry professionals who are passionate about sharing their knowledge. Our experts provide clear explanations, practical tips, and ongoing support to help you overcome challenges and achieve your learning objectives.

9.3. Comprehensive Resources

Our website features a vast library of articles, tutorials, videos, and interactive tools covering a wide range of subjects. From understanding financial statements to analyzing market trends, you’ll find everything you need to succeed in your learning journey.

9.4. Real-World Applications

We believe that learning should be relevant and applicable to your daily life. That’s why we focus on providing practical insights and real-world examples that you can use to make informed decisions and improve your skills.

9.5. Continuous Growth and Development

At LEARNS.EDU.VN, we are committed to helping you grow and develop as a lifelong learner. We regularly update our content and resources to reflect the latest trends and best practices in education and industry.

Address: 123 Education Way, Learnville, CA 90210, United States

WhatsApp: +1 555-555-1212

Website: learns.edu.vn

10. Frequently Asked Questions (FAQ)

Here are some frequently asked questions about stock trading to further clarify your understanding:

| Question | Answer |

|---|---|

| 1. Is stock trading gambling? | No, stock trading is not gambling if approached with knowledge, research, and strategy. Gambling relies on chance, while stock trading involves analyzing market trends and company performance. |

| 2. How much money do I need to start trading stocks? | You can start with as little as $100, thanks to fractional shares offered by many brokers. |

| 3. What is the best time of day to trade stocks? | The first and last hours of the trading day (9:30 AM to 10:30 AM ET and 3:00 PM to 4:00 PM ET) often see the most volatility and trading volume, which can offer opportunities for quick profits but also increased risk. |

| 4. What are the risks of stock trading? | The risks include market volatility, economic downturns, company-specific issues, and the potential for losing your investment. |

| 5. How do I choose the right stocks to trade? | Research companies thoroughly, analyze financial statements, consider market trends, and diversify your portfolio. |

| 6. What is a stock split? | A stock split is when a company increases the number of its shares to boost the stock’s liquidity. For example, in a 2-for-1 stock split, each shareholder receives an additional share for each share they hold, effectively doubling their holdings. |

| 7. How do dividends work? | Dividends are payments made by a company to its shareholders, typically from profits. The amount and frequency of dividends vary by company. |

| 8. What is a bear market? | A bear market is when the stock market experiences a prolonged period of decline, typically a drop of 20% or more from its recent high. |

| 9. What is a bull market? | A bull market is when the stock market experiences a prolonged period of growth, typically a rise of 20% or more from its recent low. |

| 10. How do I minimize my losses in stock trading? | Set stop-loss orders to automatically sell a stock if it reaches a certain price, diversify your portfolio to spread risk, and avoid investing more than you can afford to lose. |