Learning how long it takes to learn Forex trading is a common question. This article from LEARNS.EDU.VN will offer a straightforward timeframe for learning the skills and making significant progress toward consistent profitability and funding. Discover the roadmap, the mindset, and proven strategies to excel in Forex trading. Learn Forex trading strategies and improve your financial literacy.

1. Understanding The Forex Learning Journey

Learning to trade Forex markets is a transformative journey. Like mastering any new skill, Forex trading demands dedication, the right resources, and a clear understanding of the process. It’s not merely about executing trades; it’s about developing a strategic mindset, understanding market dynamics, and managing risk effectively.

1.1 Seeking Expert Guidance

The initial step in your Forex education should involve identifying and connecting with experienced mentors. These experts have navigated the complexities of the Forex market and can provide invaluable insights. Modeling successful traders can accelerate your learning curve, helping you avoid common pitfalls and develop effective strategies more efficiently. Resources from reputable institutions and educational websites can provide a solid foundation. Look for mentors who offer personalized guidance and support.

1.2 Immersing Yourself in Forex Education

Once you have a mentor, it’s time to immerse yourself in Forex education. This involves studying course content, analyzing charts, and practicing trade setups using tools like TradingView. In the beginning, focus on marking up charts, identifying entry and exit criteria, and practicing in real-time using demo accounts. This phase is critical for developing a strong understanding of market movements and building confidence in your trading decisions. Platforms like LEARNS.EDU.VN offer a variety of courses and educational materials to support your learning journey.

1.3 Practicing with Demo Accounts

Demo accounts simulate real trading conditions without the risk of losing capital. Use them to practice implementing your strategies, managing your emotions, and understanding the impact of different market scenarios on your trades.

1.4 Exploring Funding Opportunities

As you gain confidence and demonstrate consistent profitability, explore funding programs offered by proprietary firms. These firms provide traders with capital to trade, allowing you to leverage your skills and potentially earn a significant share of the profits. Passing the challenges and verification stages of these prop firms can be a major milestone in your trading career. Research different prop firms and understand their requirements and profit-sharing models.

1.5 Compounding Profits

Once you have a funded account, focus on compounding your profits by consistently executing profitable trades. Reinvesting your earnings can significantly increase your capital base and accelerate your financial growth. This stage requires disciplined risk management and a long-term perspective. Monitor your performance, adjust your strategies as needed, and continue to learn and adapt to changing market conditions.

1.6 The Average Timeline

The entire process, from beginner to consistently profitable trader with a funded account, typically takes about 12 months. However, this timeline can vary depending on your learning pace, dedication, and the quality of your education. Some traders may achieve proficiency faster, while others may require more time. Consistency, perseverance, and a willingness to learn from your mistakes are essential for success. LEARNS.EDU.VN provides resources and support to help you stay on track and achieve your trading goals.

2. The Importance of Mindset in Forex Trading

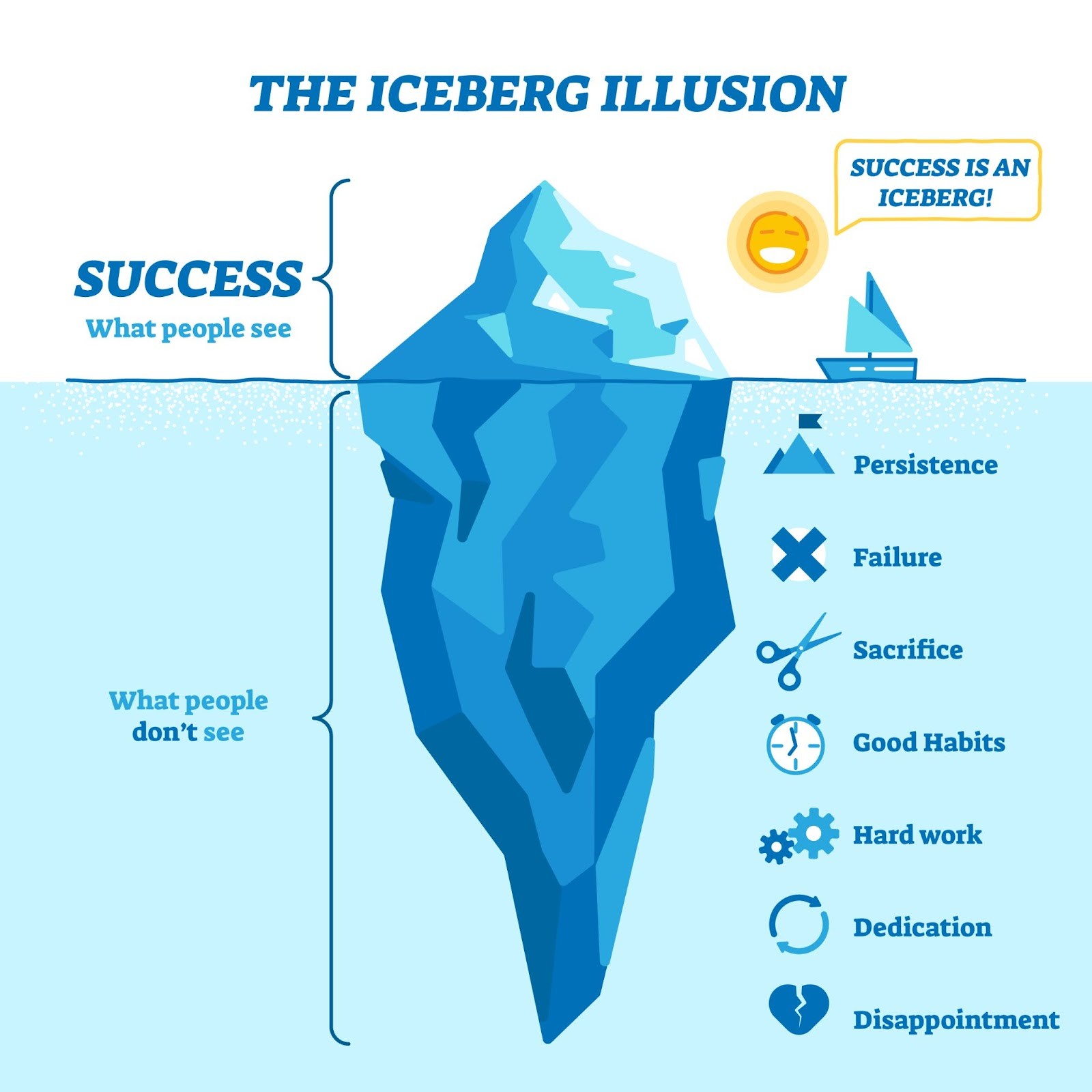

One of the most critical yet often overlooked aspects of Forex trading is mindset. A positive, resilient, and disciplined mindset can significantly impact your success.

2.1 The Role of Mindset

Many traders fail not because of a lack of knowledge or strategy, but because their expectations are unrealistic, and they become discouraged when faced with challenges. A strong mindset helps you navigate the inevitable ups and downs of trading, stay focused on your goals, and maintain a positive attitude even during losing streaks. Developing a resilient mindset is essential for long-term success in Forex trading.

2.2 Realistic Expectations

Set realistic expectations about the learning process and the time it takes to become consistently profitable. Understand that there will be setbacks and challenges along the way, and that success requires patience, perseverance, and a willingness to learn from your mistakes. Avoid get-rich-quick schemes and focus on building a solid foundation of knowledge and skills.

2.3 Maintaining Motivation

When facing adversity, remind yourself of why you started trading in the first place. What are your financial goals? What do you hope to achieve through trading? Keeping your motivations front and center can help you stay focused and committed to your goals, even when things get tough.

2.4 The Power of Community

Surrounding yourself with like-minded traders can provide invaluable support and encouragement. Join a community of traders who share your goals and values, and who can offer advice, feedback, and motivation. There is strength in numbers, and being part of a supportive community can make the learning process much easier and more enjoyable. LEARNS.EDU.VN offers a vibrant community where traders can connect, share ideas, and support each other.

3. Key Steps To Learn Forex Trading Effectively

The journey to becoming a successful Forex trader involves a series of well-defined steps. By following these steps diligently, you can increase your chances of achieving your trading goals.

3.1 Foundational Education

Start with a solid foundation of Forex education. This includes understanding the basics of currency pairs, market terminology, technical analysis, and fundamental analysis. LEARNS.EDU.VN offers comprehensive courses that cover these essential topics.

3.2 Technical Analysis

Learn how to analyze price charts using technical indicators, chart patterns, and other technical tools. Technical analysis helps you identify potential entry and exit points, as well as trends and reversals. Practice applying technical analysis to different currency pairs and timeframes.

3.3 Fundamental Analysis

Understand the economic factors that influence currency values, such as interest rates, inflation, GDP growth, and political events. Fundamental analysis helps you make informed trading decisions based on the underlying economic conditions of different countries. Stay updated on economic news and events that could impact the Forex market.

3.4 Risk Management

Develop a robust risk management strategy that includes setting stop-loss orders, limiting your leverage, and diversifying your trades. Risk management is crucial for protecting your capital and preventing significant losses. Always calculate your risk-reward ratio before entering a trade.

3.5 Trading Psychology

Understand the psychological factors that can impact your trading decisions, such as fear, greed, and overconfidence. Develop strategies for managing your emotions and staying disciplined in your trading. Maintain a trading journal to track your performance and identify patterns in your behavior.

3.6 Backtesting

Before risking real money, backtest your trading strategies using historical data. Backtesting helps you evaluate the effectiveness of your strategies and identify potential weaknesses. Use backtesting software or manually analyze historical charts to simulate your trades.

3.7 Demo Trading

Practice your trading strategies using a demo account. Demo trading allows you to trade in a risk-free environment and refine your skills before trading with real money. Treat your demo account as if it were a real account and take your trades seriously.

3.8 Live Trading

Once you are consistently profitable in your demo account, transition to live trading with a small amount of capital. Start with small trades and gradually increase your position size as you gain confidence and experience. Monitor your performance closely and adjust your strategies as needed.

3.9 Continuous Learning

The Forex market is constantly evolving, so it’s essential to stay updated on the latest news, trends, and strategies. Continuously learn and adapt to changing market conditions. Attend webinars, read books, and follow reputable Forex news sources.

4. Allocating Time To Master Forex Trading

Dedication is essential when understanding how long it takes to learn Forex trading. Allocating consistent time to learning and practice can significantly accelerate your progress.

4.1 Structured Learning Schedule

Create a structured learning schedule that includes dedicated time for studying, analyzing charts, practicing trades, and reviewing your performance. Consistency is key, so stick to your schedule as much as possible.

4.2 Time Commitment

Allocate at least 1-2 hours per day to Forex education and practice. The more time you invest, the faster you will learn and improve your skills. However, avoid burnout by taking breaks and maintaining a healthy work-life balance.

4.3 Setting Realistic Goals

Set realistic goals for your learning progress. Don’t expect to become a consistently profitable trader overnight. Focus on making small, incremental improvements each day, and celebrate your achievements along the way.

4.4 Maximizing Learning Efficiency

Maximize your learning efficiency by focusing on the most important concepts and strategies. Avoid getting overwhelmed by too much information. Prioritize quality over quantity and focus on mastering the fundamentals before moving on to more advanced topics.

5. Essential Forex Trading Terminology

Understanding key terminology is crucial for navigating the Forex market. Here’s a glossary of essential terms:

| Term | Definition |

|---|---|

| Pip | The smallest price movement a currency pair can make. |

| Leverage | The use of borrowed capital to increase the potential return of an investment. |

| Margin | The amount of money required to open and maintain a leveraged position. |

| Spread | The difference between the bid and ask price of a currency pair. |

| Stop-Loss | An order placed with a broker to buy or sell a currency pair when it reaches a certain price. |

| Take-Profit | An order placed with a broker to buy or sell a currency pair when it reaches a specific profit target. |

| Lot Size | A standardized unit of measurement for trading volume. |

| Currency Pair | Two currencies that are traded against each other in the Forex market. |

6. Advanced Forex Trading Strategies

Once you’ve mastered the basics, explore advanced trading strategies to enhance your profitability.

6.1 Elliott Wave Theory

The Elliott Wave Theory suggests that market prices move in specific patterns called waves, which can be used to predict future price movements.

6.2 Fibonacci Retracement

Fibonacci Retracement levels are horizontal lines that indicate potential support and resistance levels based on Fibonacci ratios.

6.3 Harmonic Patterns

Harmonic patterns are geometric price patterns that can be used to identify potential reversal points in the market.

6.4 Algorithmic Trading

Algorithmic trading involves using computer programs to execute trades based on predefined rules and criteria.

6.5 News Trading

News trading involves making trading decisions based on economic news releases and events.

7. Selecting The Right Forex Trading Tools

Choosing the right tools can significantly enhance your trading experience.

7.1 Trading Platforms

Select a reputable trading platform that offers a user-friendly interface, advanced charting tools, and reliable order execution. Popular platforms include MetaTrader 4, MetaTrader 5, and cTrader.

7.2 Charting Software

Use charting software to analyze price charts, identify trends, and apply technical indicators. TradingView is a popular charting platform that offers a wide range of features and tools.

7.3 Economic Calendar

Stay updated on economic news releases and events using an economic calendar. Forex Factory and DailyFX are popular economic calendars that provide real-time updates and forecasts.

7.4 Forex News Sources

Follow reputable Forex news sources to stay informed about market trends, economic developments, and political events. Bloomberg, Reuters, and CNBC are reliable news sources that provide comprehensive coverage of the Forex market.

7.5 Trading Journal

Maintain a trading journal to track your trades, analyze your performance, and identify patterns in your behavior. A trading journal can help you improve your trading skills and make more informed decisions.

8. Avoiding Common Pitfalls In Forex Trading

Many traders make mistakes that can lead to losses. Avoiding these pitfalls can significantly improve your chances of success.

8.1 Overtrading

Avoid overtrading by focusing on high-quality trades that meet your criteria. Don’t trade just for the sake of trading. Be patient and wait for the right opportunities.

8.2 Trading Without A Plan

Always trade with a well-defined trading plan that includes your entry and exit criteria, risk management rules, and profit targets. Don’t trade impulsively or without a clear strategy.

8.3 Ignoring Risk Management

Never ignore risk management. Always set stop-loss orders and limit your leverage to protect your capital. Risk management is essential for long-term success in Forex trading.

8.4 Chasing Losses

Avoid chasing losses by increasing your position size or taking on more risk after a losing trade. Stick to your trading plan and don’t let your emotions influence your decisions.

8.5 Being Overconfident

Don’t become overconfident after a winning streak. Stay humble and continue to learn and adapt to changing market conditions. The Forex market is constantly evolving, so it’s essential to remain vigilant and avoid complacency.

9. Forex Trading Success Stories

Learning from others’ success stories can be inspiring and provide valuable insights.

9.1 The Disciplined Day Trader

A day trader who consistently applied technical analysis and risk management achieved significant profitability within two years. Their discipline and adherence to their trading plan were key to their success.

9.2 The Patient Swing Trader

A swing trader who focused on fundamental analysis and held positions for several weeks achieved consistent returns over time. Their patience and understanding of economic trends were essential to their success.

9.3 The Algorithmic Trader

An algorithmic trader who developed a sophisticated trading algorithm achieved high levels of profitability with minimal manual intervention. Their technical skills and understanding of market dynamics were crucial to their success.

10. Resources From LEARNS.EDU.VN To Enhance Your Forex Journey

To further support your Forex trading journey, LEARNS.EDU.VN offers a variety of resources, including:

- Comprehensive Forex Courses: Covering everything from the basics to advanced strategies.

- Expert Mentorship: Providing personalized guidance and support.

- Trading Community: Connecting you with like-minded traders.

- Risk Management Tools: Helping you protect your capital.

- Economic Calendar: Keeping you updated on economic news and events.

- Trading Journal: Tracking your performance and identifying patterns.

FAQ: Your Forex Trading Questions Answered

1. Can Forex trading be self-taught, or is a mentor necessary?

While self-teaching is possible, a mentor can significantly accelerate your learning curve by providing personalized guidance and insights.

2. What’s the minimum capital required to start Forex trading?

You can start with as little as $100, but it’s essential to manage your risk and leverage appropriately.

3. How can I stay updated with the latest Forex market trends?

Follow reputable Forex news sources, attend webinars, and participate in trading communities.

4. What are the essential qualities of a successful Forex trader?

Discipline, patience, risk management, and continuous learning are essential qualities.

5. How can I protect myself from Forex trading scams?

Research brokers thoroughly, avoid unrealistic promises, and never invest more than you can afford to lose.

6. Is Forex trading suitable for beginners with no financial background?

Yes, but it’s crucial to start with a solid foundation of education and practice.

7. How important is technical analysis in Forex trading?

Technical analysis is crucial for identifying potential entry and exit points, as well as trends and reversals.

8. What role does fundamental analysis play in Forex trading?

Fundamental analysis helps you make informed trading decisions based on the underlying economic conditions of different countries.

9. How can I manage my emotions while trading Forex?

Develop strategies for managing your emotions, such as setting realistic expectations, taking breaks, and avoiding overtrading.

10. What are the tax implications of Forex trading?

Consult a tax professional to understand the tax implications of Forex trading in your jurisdiction.

Conclusion

Learning Forex trading is a journey that requires dedication, the right resources, and a positive mindset. By following the steps outlined in this article and utilizing the resources available at LEARNS.EDU.VN, you can increase your chances of achieving your trading goals. Remember, success in Forex trading is not a sprint, but a marathon. Stay focused, stay disciplined, and never stop learning.

Ready to embark on your Forex trading journey? Visit LEARNS.EDU.VN today and explore our comprehensive courses, expert mentorship, and vibrant trading community. Our resources are designed to help you develop the skills and knowledge you need to succeed in the Forex market. Don’t wait, start your journey to financial freedom today!

Contact us at 123 Education Way, Learnville, CA 90210, United States. Reach out via Whatsapp at +1 555-555-1212. And explore our website at learns.edu.vn to learn more.

Robert Castillo

FX Trader & Analyst

Writer & Editor