Can you learn stock trading on your own? Absolutely! This guide provides a roadmap for self-directed learning in the stock market. At LEARNS.EDU.VN, we believe that with the right resources and dedication, anyone can acquire the knowledge and skills necessary to navigate the world of stock trading. Whether you’re interested in long-term investing or active trading, understanding market dynamics, investment strategies, and risk management is crucial for success. Start your journey towards financial literacy with insights into stock analysis, trading platforms, and portfolio management, while embracing self-education through online resources and community support.

1. Understanding the Basics of Stock Trading

Before diving into the specifics of learning stock trading, it’s important to understand what stock trading is all about. Stock trading involves buying and selling shares of publicly traded companies with the goal of profiting from price fluctuations.

1.1. What is Stock Trading?

Stock trading, or equity trading, is the process of buying and selling shares of companies listed on stock exchanges. These shares represent ownership in the company, and their prices fluctuate based on market demand and company performance. Popular stocks include Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Google (GOOGL).

1.2. How Does the Stock Market Work?

In the stock market, every transaction requires both a buyer and a seller. The price of a stock is determined by the balance between supply and demand. High demand leads to rising prices, while low demand causes prices to fall. Economic news, company earnings, and global events can all influence stock prices.

2. Why Learn Stock Trading on Your Own?

Learning stock trading on your own offers flexibility, personalized learning, and cost savings.

2.1. Flexibility and Convenience

Self-directed learning allows you to study at your own pace and on your own schedule. You can choose the resources that best suit your learning style and focus on areas that are most relevant to your interests and goals.

2.2. Personalized Learning Experience

When you learn on your own, you can tailor your education to your specific needs and interests. Whether you’re interested in value investing, growth investing, or day trading, you can find resources and strategies that align with your preferred approach.

2.3. Cost-Effectiveness

Self-directed learning can be more affordable than formal courses or seminars. There are many free or low-cost resources available online, including articles, videos, and webinars. You can also save money on travel and accommodation expenses.

3. Essential Steps to Learn Stock Trading Independently

Here’s a step-by-step guide to help you learn stock trading on your own:

3.1. Open a Brokerage Account

To start trading stocks, you’ll need to open an account with an online broker. Look for brokers that offer educational resources, user-friendly platforms, and competitive fees. Popular options include Fidelity, Charles Schwab, E*TRADE, and Merrill Edge.

Opening a brokerage account is the first practical step toward actively participating in the stock market. These accounts serve as the gateway through which you’ll buy and sell stocks, manage your investments, and track your portfolio’s performance. Selecting the right brokerage account is critical, as it can significantly impact your trading experience and overall investment success. Consider the following factors when choosing a brokerage:

- Fees and Commissions:

- Commission-Free Trading: Many brokers now offer commission-free trading for stocks and ETFs, which can save you a significant amount of money, especially if you plan to make frequent trades.

- Other Fees: Be aware of other potential fees, such as account maintenance fees, inactivity fees, and transfer fees.

- Trading Platform and Tools:

- User-Friendliness: Opt for a platform that is easy to navigate and understand, especially if you are new to trading.

- Charting Tools: Look for robust charting tools that allow you to analyze stock price movements and identify potential trading opportunities.

- Research Resources: Access to high-quality research reports, analyst ratings, and market news can help you make informed investment decisions.

- Educational Resources:

- Beginner-Friendly Content: Choose a broker that provides a wealth of educational materials, such as articles, videos, and webinars, to help you learn the ropes of stock trading.

- Demo Accounts: Some brokers offer demo accounts that allow you to practice trading with virtual money before risking real capital.

3.2. Follow the Stock Market

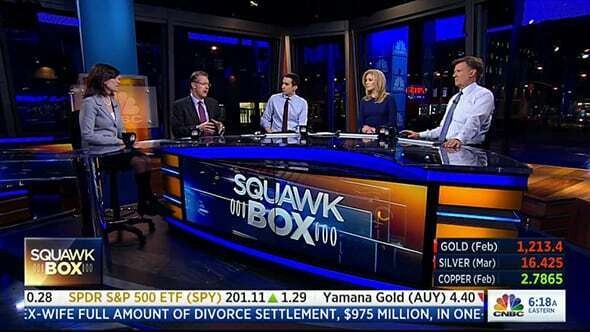

Stay informed about market trends and economic news by following reputable news sources like MarketWatch and The Wall Street Journal. Watching financial news channels like CNBC and Bloomberg can also help you familiarize yourself with market terminology and analysis.

Casually following the stock market is an essential practice for anyone looking to understand the dynamics of investing and trading. This involves regularly monitoring market trends, economic news, and company performance to gain insights into the factors that drive stock prices. Here’s why this practice is so important and how you can effectively implement it:

- Understanding Economic Trends: Economic indicators such as GDP growth, inflation rates, and unemployment figures can significantly impact the stock market. By staying informed about these trends, you can better anticipate market movements and adjust your investment strategies accordingly.

- Learning Market Jargon: The stock market has its own unique language, with terms like “bull market,” “bear market,” “volatility,” and “liquidity” being commonly used. By following market news, you’ll gradually become familiar with this terminology and improve your understanding of market discussions.

- Identifying Third-Party Analysis: Reputable news sources often provide analysis from experts who offer insights into market trends and individual stocks. These analyses can help you develop your own investment theses and make more informed decisions.

- Using Online Resources:

- Yahoo Finance: A comprehensive platform for tracking stock quotes, viewing stock charts, reading news headlines, and accessing fundamental data.

- Google Finance: Similar to Yahoo Finance, it provides real-time stock quotes, news, and market analysis.

- Bloomberg and CNBC: Financial news channels that offer live coverage of market events, interviews with industry experts, and in-depth analysis of economic trends.

3.3. Find a Mentor or Trading Community

Connect with experienced traders who can offer guidance, answer questions, and provide support. Look for mentors within your network or join online trading communities to learn from others.

Having a mentor or being part of a trading community can provide invaluable support and guidance as you navigate the complexities of the stock market. These relationships offer the opportunity to learn from experienced traders, gain insights into market dynamics, and receive encouragement during challenging times. Here’s how to find and leverage a mentor or trading community:

- Benefits of a Mentor:

- Expert Guidance: A mentor can share their knowledge, experience, and strategies, helping you avoid common pitfalls and accelerate your learning curve.

- Objective Feedback: A mentor can provide unbiased feedback on your trading decisions, helping you identify areas for improvement.

- Emotional Support: Trading can be emotionally challenging, and a mentor can offer encouragement and support during periods of losses or uncertainty.

- Benefits of a Trading Community:

- Diverse Perspectives: A trading community brings together individuals with diverse backgrounds, experiences, and trading styles, providing a wide range of perspectives on market trends and investment opportunities.

- Collaborative Learning: Trading communities foster a collaborative learning environment where members can share ideas, ask questions, and learn from each other’s successes and failures.

- Networking Opportunities: Joining a trading community can provide valuable networking opportunities, allowing you to connect with other traders, potential mentors, and industry professionals.

3.4. Study Successful Investors

Learn from the strategies and philosophies of successful investors like Warren Buffett, Jesse Livermore, and Peter Lynch. Reading their biographies and studying their investment approaches can provide valuable insights into effective trading.

Studying successful investors is akin to learning from the masters. By examining their strategies, philosophies, and experiences, you can gain invaluable insights into the art and science of investing. Here are some of the most influential investors and the key lessons you can learn from them:

- Warren Buffett: Known as the “Oracle of Omaha,” Warren Buffett is one of the most successful investors of all time. His approach is rooted in value investing, which involves identifying undervalued companies with strong fundamentals and holding them for the long term.

- Key Lessons:

- Value Investing: Focus on buying companies that are trading below their intrinsic value.

- Long-Term Perspective: Invest for the long haul and avoid short-term market fluctuations.

- Circle of Competence: Invest in industries and companies that you understand well.

- Key Lessons:

- Jesse Livermore: A legendary stock trader from the early 20th century, Jesse Livermore was known for his ability to predict market trends and profit from them. He was a master of technical analysis and trend following.

- Key Lessons:

- Cut Losses Quickly: Limit your losses by using stop-loss orders and exiting losing positions promptly.

- Let Profits Run: Allow your winning positions to grow as long as the trend continues.

- Control Emotions: Avoid making impulsive decisions based on fear or greed.

- Key Lessons:

- Peter Lynch: As the manager of the Fidelity Magellan Fund, Peter Lynch achieved remarkable returns by investing in companies that he understood and that were growing rapidly.

- Key Lessons:

- Invest in What You Know: Look for investment opportunities in your everyday life and in industries that you are familiar with.

- Do Your Homework: Research companies thoroughly before investing, paying attention to their financials, management, and competitive landscape.

- Be Patient: Allow your investments time to grow and don’t panic sell during market downturns.

- Key Lessons:

3.5. Read Books, Articles, and Listen to Podcasts

Immerse yourself in trading knowledge by reading books, articles, and listening to podcasts. Some recommended books include “How to Make Money in Stocks” by William O’Neil and “The Intelligent Investor” by Benjamin Graham.

The world of stock trading is vast and ever-evolving, making continuous learning essential for success. Immersing yourself in trading knowledge through books, articles, and podcasts can provide you with the insights, strategies, and perspectives you need to navigate the complexities of the market. Here’s a guide to help you make the most of these resources:

- Books:

- “How to Make Money in Stocks” by William O’Neil: A classic guide to the CAN SLIM investment strategy, which focuses on identifying growth stocks with strong earnings and price momentum.

- “The Intelligent Investor” by Benjamin Graham: Considered the bible of value investing, this book teaches you how to analyze companies, assess their intrinsic value, and buy them when they are trading at a discount.

- “Reminiscences of a Stock Operator” by Edwin Lefevre: A fictionalized biography of legendary stock trader Jesse Livermore, offering valuable insights into market psychology, risk management, and the importance of discipline.

- “One Up On Wall Street” by Peter Lynch: A practical guide to investing in what you know, based on Peter Lynch’s successful career as the manager of the Fidelity Magellan Fund.

- Articles:

- StockBrokers.com: Offers a wealth of educational articles on various topics, including beginner’s guides, trading strategies, and broker reviews.

- Investopedia: A comprehensive online resource for financial education, with articles covering everything from basic investing concepts to advanced trading techniques.

- The Wall Street Journal and MarketWatch: Reputable news sources that provide in-depth coverage of market trends, economic news, and company performance.

- Podcasts:

- InvestTalk: A daily radio show and podcast where hosts Justin Klein and Steve Peasley provide unbiased investment advice and answer listener questions.

- The Motley Fool Money: A weekly podcast that covers the latest business and investing news, with interviews with industry experts and discussions of stock picks.

- Chat With Traders: Interviews with professional traders, offering insights into their strategies, mindsets, and experiences.

3.6. Consider Paid Subscriptions (But Be Skeptical)

Some paid subscription services can offer valuable insights, but be cautious of those that promise guaranteed profits. Investor’s Business Daily and The Wall Street Journal are reputable options.

Navigating the world of paid subscription services in stock trading requires a healthy dose of skepticism. While some services can provide valuable insights and analysis, many others are simply scams or overhyped products that fail to deliver on their promises. Here’s how to approach paid subscriptions with caution:

- Evaluate the Source:

- Reputation: Research the provider’s reputation and track record. Look for independent reviews and testimonials from reputable sources.

- Transparency: Be wary of services that lack transparency about their methods, performance, and team.

- Conflicts of Interest: Consider any potential conflicts of interest. For example, some services may promote stocks that they own or have a financial interest in.

- Assess the Content:

- Quality: Look for services that provide high-quality, well-researched content that is based on sound investment principles.

- Actionable Insights: The content should provide actionable insights that you can use to make informed trading decisions.

- Educational Value: The service should offer educational resources that help you improve your understanding of the market and trading strategies.

- Beware of Red Flags:

- Guaranteed Profits: Be highly skeptical of any service that promises guaranteed profits or unrealistic returns.

- High-Pressure Sales Tactics: Watch out for services that use high-pressure sales tactics or create a sense of urgency to get you to sign up.

- Unrealistic Testimonials: Be wary of testimonials that seem too good to be true or that lack specific details.

3.7. Explore Seminars, Online Courses, or Live Classes (Cautiously)

Seminars and courses can provide valuable insights, but they can also be expensive. Look for reputable providers and be wary of sales pitches. Will O’Neil workshops, Dan Zanger, and Mark Minervini are potential options.

Exploring seminars, online courses, and live classes can be a valuable way to deepen your knowledge of stock trading and gain insights from experienced professionals. However, it’s crucial to approach these opportunities with caution, as many can be expensive and may not deliver the promised results. Here’s a guide to help you navigate these options:

- Evaluate the Instructor:

- Experience: Look for instructors with a proven track record of success in the stock market.

- Credentials: Check the instructor’s credentials and qualifications. Are they certified financial analysts (CFAs) or do they hold other relevant certifications?

- Reputation: Research the instructor’s reputation and look for independent reviews from past students.

- Assess the Curriculum:

- Comprehensive Coverage: The curriculum should cover a wide range of topics, including market fundamentals, technical analysis, risk management, and trading strategies.

- Practical Application: The course should provide opportunities for practical application, such as simulations, case studies, and live trading sessions.

- Up-to-Date Content: The content should be up-to-date and reflect the current market conditions and regulatory environment.

- Consider the Cost:

- Value for Money: Evaluate whether the course offers good value for money. Consider the length of the course, the amount of content, and the level of support provided.

- Payment Options: Check if the course offers flexible payment options or a money-back guarantee.

- Hidden Fees: Be aware of any hidden fees or additional costs, such as required software or data subscriptions.

3.8. Practice Trading with a Simulator

Before risking real money, practice trading with a stock simulator or paper trading account. This allows you to test your strategies and get familiar with the trading platform without financial risk. Brokers like E*TRADE, Webull, and TradeStation offer paper trading accounts.

Practicing trading with a simulator, also known as paper trading, is an invaluable step for anyone new to the stock market. It allows you to test your strategies, familiarize yourself with trading platforms, and gain confidence without risking real money. Here’s why paper trading is so important and how to make the most of it:

- Benefits of Paper Trading:

- Risk-Free Learning: The primary benefit of paper trading is that it allows you to learn the ropes of stock trading without risking any of your own capital.

- Platform Familiarization: Paper trading provides an opportunity to become familiar with the features and functionality of a trading platform, such as order entry, charting tools, and account management.

- Strategy Testing: You can use paper trading to test different trading strategies and see how they perform in various market conditions.

- Emotional Preparation: Paper trading can help you prepare for the emotional challenges of real-world trading, such as managing fear and greed.

- Choosing a Paper Trading Account:

- Brokerage Integration: Some online brokers offer paper trading accounts that are integrated with their real-money trading platforms. This allows you to seamlessly transition from paper trading to real trading when you’re ready.

- Real-Time Data: Look for paper trading accounts that provide real-time market data, so you can make informed trading decisions.

- Customization Options: Some paper trading accounts offer customization options, such as the ability to set your starting balance, choose the types of securities you want to trade, and adjust the market conditions.

- Tips for Effective Paper Trading:

- Treat it Like Real Trading: Approach paper trading with the same seriousness and discipline as you would real trading.

- Set Realistic Goals: Set realistic goals for your paper trading activities, such as achieving a certain return or mastering a particular trading strategy.

- Track Your Results: Keep a detailed record of your paper trades, including the entry and exit prices, the reasons for your decisions, and the results of each trade.

- Analyze Your Mistakes: Don’t be afraid to make mistakes in paper trading. Analyze your mistakes and learn from them so you can avoid making them in real trading.

3.9. Buy Your First Shares of Stock (Start Small)

Once you’re comfortable with the trading platform and have developed a trading strategy, start trading with a small amount of real money. Don’t risk more than you can afford to lose, and gradually increase your investment as you gain experience.

Once you’ve gained some experience with paper trading and developed a solid understanding of the stock market, it’s time to take the plunge and buy your first shares of stock with real money. This can be an exciting but also nerve-wracking experience. Here’s how to approach it responsibly and effectively:

- Start Small:

- Affordable Amount: Begin with an amount of money that you can afford to lose without causing significant financial hardship.

- Fractional Shares: Consider buying fractional shares of stock, which allow you to invest in companies with high share prices without having to purchase a full share.

- Educational Purpose: View your initial investments as an educational opportunity rather than a get-rich-quick scheme.

- Choose Your Stocks Wisely:

- Familiar Companies: Invest in companies that you are familiar with and that you understand well.

- Diversification: Diversify your portfolio by investing in stocks from different industries and sectors.

- Long-Term Potential: Look for companies with strong fundamentals and long-term growth potential.

- Manage Your Risk:

- Stop-Loss Orders: Use stop-loss orders to limit your potential losses on each trade.

- Position Sizing: Determine the appropriate position size for each trade based on your risk tolerance and account size.

- Emotional Control: Control your emotions and avoid making impulsive decisions based on fear or greed.

- Track Your Performance:

- Trading Journal: Keep a detailed trading journal to track your trades, analyze your results, and identify areas for improvement.

- Regular Review: Review your portfolio regularly to assess your performance and make adjustments as needed.

- Learn from Mistakes: Don’t be afraid to make mistakes. Learn from your mistakes and use them as opportunities to improve your trading skills.

3.10. Buy and Hold the Market

Consider following Warren Buffett’s advice and invest in a diversified index fund for the long term. This can be a simpler and more effective strategy than trying to beat the market through active trading.

Following Warren Buffett’s advice to “buy and hold the market” is a time-tested strategy for long-term wealth creation. It involves investing in a diversified portfolio of stocks and holding them for an extended period, regardless of short-term market fluctuations. Here’s why this strategy is so effective and how to implement it:

- Benefits of Buying and Holding the Market:

- Diversification: Investing in a diversified portfolio of stocks reduces your risk by spreading your investments across a wide range of companies and industries.

- Compounding Returns: Over the long term, the stock market has historically provided attractive returns. By holding your investments for an extended period, you can benefit from the power of compounding, where your earnings generate further earnings.

- Reduced Trading Costs: Buying and holding the market eliminates the need for frequent trading, which can save you money on commissions and other transaction costs.

- Simplicity: This strategy is simple to implement and requires minimal effort once your portfolio is set up.

- How to Implement the Strategy:

- Index Funds or ETFs: Invest in low-cost index funds or exchange-traded funds (ETFs) that track a broad market index, such as the S&P 500.

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of market conditions. This strategy, known as dollar-cost averaging, can help you buy more shares when prices are low and fewer shares when prices are high.

- Reinvest Dividends: Reinvest any dividends you receive back into your portfolio to further enhance your returns.

- Stay the Course: Avoid making impulsive decisions based on short-term market fluctuations. Stick to your long-term investment plan and resist the urge to sell during market downturns.

4. Key Trading Strategies to Explore

There are several trading strategies you can consider as you learn stock trading. Each strategy has its own advantages and disadvantages.

4.1. Day Trading

Day trading involves buying and selling stocks within the same day. It requires quick decision-making and a deep understanding of market dynamics. Day trading can be expensive due to frequent trading and short-term capital gains taxes.

4.2. Swing Trading

Swing trading involves holding stocks for more than a day, up to a few weeks. It’s suitable for stocks that bounce between established support and resistance levels. Swing trading requires technical analysis to identify trading ranges.

4.3. Momentum Trading

Momentum trading involves following trends. If a stock is trending upward, you buy and hold until the trend weakens. If a stock is falling, you sell short until the trend plateaus.

4.4. Penny Stock Trading

Penny stock trading involves buying shares of small companies that trade for less than $5 a share. Penny stocks are often traded over the counter and are typically priced low for a reason. Using a reputable broker is important.

5. Understanding ETFs and Mutual Funds

ETFs (exchange-traded funds) and mutual funds are investment vehicles that hold a collection of stocks or bonds.

5.1. What are ETFs?

ETFs trade like stocks and fluctuate in price depending on supply and demand. They offer diversification by holding shares in multiple companies.

5.2. What are Mutual Funds?

Mutual funds are priced each day after the market closes, and everyone pays the same price. They typically require a higher minimum investment than ETFs.

6. Learning from Famous Stock Traders: Key Tips

Drawing wisdom from successful investors can provide valuable insights for your own trading journey.

6.1. William O’Neil’s Tips

William O’Neil, the founder of CAN SLIM investing, emphasizes persistence and learning from both successes and mistakes. He advises setting up a cash account and focusing on a few high-quality stocks.

- Persistence is key when learning to invest; don’t get discouraged.

- Set up a cash account, not a margin account, as a beginner.

- Concentrate on a few, high-quality stocks.

6.2. Jesse Livermore’s Tips

Jesse Livermore, one of the greatest investors of all time, advises cutting losses quickly and confirming judgments before going all in. He emphasizes watching leading stocks for the best action.

- Cut your losses quickly.

- Confirm your judgments before going all in.

- Watch leading stocks for the best action.

6.3. John Paulson’s Tips

John Paulson, a hedge fund manager, advises not relying on experts and always having an exit strategy. He emphasizes educating yourself on new investment vehicles.

- Don’t rely on experts; be skeptical.

- Always have an exit strategy.

- Always educate yourself on new investment vehicles.

7. Final Thoughts and Encouragement

Learning stock trading on your own is possible with dedication, the right resources, and a willingness to learn from your mistakes. Start small, stay informed, and gradually increase your investment as you gain experience.

7.1. Can You Teach Yourself How to Trade?

Yes, you can teach yourself how to trade stocks. While mentors can help, you don’t need to find a teacher to learn how to trade stocks. Whether or not you have a mentor, you should still read books, invest a small amount of your own money, and take advantage of free educational materials.

7.2. Is Trading Easy to Learn?

Trading is easy to do, but whether it’s easy to learn depends on your ability to spot patterns, the style of trading you choose, and how curious you are about how markets work.

7.3. What is the Best Free Way to Learn Stock Trading?

The best free way to learn stock trading is to open a broker account and trade a virtual portfolio, also called “paper trading,” which lets you learn about the market without risking actual money.

7.4. Can You Get Rich By Trading Stocks?

Yes, but it’s more likely you’ll become richer from patiently holding a diversified portfolio of quality stocks for a long time. There is no shortcut to accumulating wealth.

8. FAQs: Learning Stock Trading

Q1: How long does it take to learn stock trading?

A: The time it takes to learn stock trading varies depending on individual learning speed, dedication, and the depth of knowledge desired. Some people may grasp the basics within a few months, while others may take a year or more to become proficient.

Q2: What are the essential skills needed for stock trading?

A: Essential skills include understanding market dynamics, financial analysis, risk management, and technical analysis. Emotional discipline and continuous learning are also crucial.

Q3: Can I start stock trading with $100?

A: Yes, you can start trading with $100 or as little as you want. Thanks to many brokers now offering fractional stock shares, these days you can buy part of one share of a $300 stock with as little as $5.

Q4: Which stock trading site is best for beginners?

A: Fidelity is a top pick for beginners. It has great apps, including the unique Fidelity Youth app for teens, and lots of educational resources. It also offers fractional shares, which are a great way to dip your toe into stock trading.

Q5: Is it better to invest in individual stocks or ETFs?

A: It depends on your risk tolerance and investment goals. Individual stocks offer the potential for higher returns but also carry higher risk. ETFs provide diversification and lower risk.

Q6: How important is technical analysis in stock trading?

A: Technical analysis is important for short-term trading strategies like day trading and swing trading. It involves analyzing stock charts and patterns to identify potential trading opportunities.

Q7: How can I manage risk in stock trading?

A: Risk management techniques include setting stop-loss orders, diversifying your portfolio, and not investing more than you can afford to lose.

Q8: What are the common mistakes new traders make?

A: Common mistakes include trading emotionally, not doing enough research, and risking too much capital on a single trade.

Q9: Is it necessary to have a financial advisor to start trading stocks?

A: No, it’s not necessary. Many people successfully trade stocks on their own. However, a financial advisor can provide valuable guidance and support, especially for beginners.

Q10: What resources does LEARNS.EDU.VN offer for learning stock trading?

A: At LEARNS.EDU.VN, we offer a wide range of educational resources, including articles, courses, and community forums. Our resources are designed to help you learn stock trading at your own pace and achieve your financial goals.

At LEARNS.EDU.VN, we’re committed to providing you with the knowledge and resources you need to succeed in stock trading. Visit our website today to explore our comprehensive range of articles, courses, and community forums.

Ready to take the next step in your stock trading journey?

Visit LEARNS.EDU.VN to explore our comprehensive range of articles and courses designed to help you learn the ins and outs of stock trading. Our expert-led resources will provide you with the knowledge and skills you need to navigate the market with confidence.

- Address: 123 Education Way, Learnville, CA 90210, United States

- WhatsApp: +1 555-555-1212

- Website: LEARNS.EDU.VN

Start your journey towards financial literacy and investment success with learns.edu.vn today!