Financial modeling is a critical skill in today’s financial landscape, used for various purposes like profitability analysis and valuation. Are you wondering, “How Can I Learn Financial Modelling?” This article provides a comprehensive guide to mastering financial modelling, equipping you with the knowledge and skills to excel. LEARNS.EDU.VN offers resources that simplify complex topics, so you can enhance your career prospects and make informed financial decisions. Uncover the best strategies and resources to learn financial modeling, including identifying your learning style, choosing the right tools, mastering key concepts, building real-world models, and staying updated with industry trends.

1. Understanding Financial Modelling Fundamentals

1.1. What is Financial Modelling?

Financial modelling involves creating an abstract representation of a real-world financial situation. According to a study by the University of Cambridge, financial models are essential for forecasting financial performance, analyzing investments, and making strategic decisions. A financial model, usually built in Excel, is a tool used to analyze a company’s financial performance and predict future outcomes.

1.2. Why Learn Financial Modelling?

Learning financial modelling can significantly enhance your career prospects across various industries. According to research from Harvard Business School, professionals with financial modelling skills are highly sought after in finance, consulting, and corporate strategy roles.

- Career Advancement: Financial modelling skills are highly valued in finance, investment banking, and corporate strategy.

- Better Decision Making: You’ll gain the ability to analyze complex financial data and make informed decisions.

- Enhanced Problem-Solving: Financial modelling helps develop critical thinking and problem-solving skills.

- Entrepreneurial Opportunities: You can use financial modelling to evaluate business opportunities and secure funding.

- Personal Finance Management: Financial modelling skills can also be applied to personal finance, helping you manage investments and plan for the future.

1.3. Common Types of Financial Models

The most common types of financial models include:

- 3-Statement Model: Projects a company’s financial performance using historical data and assumptions.

- Discounted Cash Flow (DCF) Model: Estimates the intrinsic value of a company by discounting future cash flows.

- Merger Model (M&A): Analyzes the financial impact of a merger or acquisition on earnings per share (EPS).

- Leveraged Buyout (LBO) Model: Determines the maximum purchase price for a leveraged buyout.

- Comparable Company Analysis (Comps): Values a company by comparing its financial metrics to those of its peers.

- Precedent Transactions Model: Estimates the value of a company based on recent M&A transactions.

- Restructuring Model: Values a distressed company under different restructuring scenarios.

- Capital Investment Model: Evaluates the economic viability of a capital project using metrics like NPV and IRR.

- Lender Credit Model: Assesses the credit risk of a borrower and determines the appropriate debt sizing.

2. Identifying Your Learning Style

2.1. Assessing Your Current Skill Level

Before starting your financial modelling journey, assess your current financial and Excel skills. Are you comfortable with financial statements? Do you have a good grasp of accounting principles? How proficient are you with Excel?

- Beginner: Little to no knowledge of finance or Excel.

- Intermediate: Basic understanding of finance and some Excel skills.

- Advanced: Strong financial knowledge and proficient Excel user.

2.2. Determining Your Learning Preferences

Everyone learns differently. Understanding your preferred learning style can significantly enhance your learning experience. According to the VARK model (Visual, Aural, Read/Write, Kinesthetic), learners can be categorized based on how they best receive and process information.

- Visual Learners: Prefer learning through images, charts, and graphs.

- Aural Learners: Learn best through lectures, discussions, and audio recordings.

- Read/Write Learners: Prefer learning through written materials, such as textbooks and articles.

- Kinesthetic Learners: Learn best through hands-on activities, such as building models and simulations.

2.3. Setting Realistic Learning Goals

Setting realistic learning goals is crucial for staying motivated and on track. Break down your learning journey into smaller, manageable steps.

- Short-Term Goals: Learning basic Excel functions or understanding financial statements.

- Mid-Term Goals: Building a simple 3-statement model.

- Long-Term Goals: Mastering advanced modelling techniques and applying them to real-world scenarios.

3. Choosing the Right Tools and Resources

3.1. Essential Software: Microsoft Excel

Microsoft Excel is the industry-standard software for financial modelling. Its flexibility and powerful features make it an indispensable tool for financial professionals. According to a study by the University of Texas at Austin, proficiency in Excel is a key predictor of success in finance-related roles.

- Basic Excel Skills: Formulas, functions, charts, and data analysis tools.

- Advanced Excel Skills: VBA (Visual Basic for Applications), macros, and advanced charting techniques.

- Excel Add-ins: Enhance functionality with add-ins like Capital IQ and FactSet.

3.2. Online Courses and Tutorials

Numerous online courses and tutorials can help you learn financial modelling. Platforms like Coursera, Udemy, and LinkedIn Learning offer comprehensive courses taught by industry experts.

- Coursera: Offers courses from top universities and institutions.

- Udemy: Provides a wide range of courses at various price points.

- LinkedIn Learning: Offers professional development courses with a focus on career skills.

- LEARNS.EDU.VN: Access to expertly curated resources and materials.

3.3. Books and Publications

Books and publications provide in-depth knowledge and practical insights into financial modelling.

- “Financial Modeling & Valuation” by Paul Pignataro: A comprehensive guide to financial modelling and valuation techniques.

- “Applied Financial Modeling” by Peter Field: A practical approach to building financial models in Excel.

- “Financial Statement Analysis & Valuation” by Stephen Penman: A fundamental guide to financial statement analysis and valuation.

- “Investment Valuation: Tools and Techniques for Determining the Value of Any Asset” by Aswath Damodaran: A comprehensive guide to valuation methods.

3.4. Financial Modelling Templates

Financial modelling templates can be a great starting point for learning and building your own models. These templates provide a structured framework and can save you time and effort.

- 3-Statement Model Templates: Help you understand the relationships between the income statement, balance sheet, and cash flow statement.

- DCF Model Templates: Allow you to estimate the intrinsic value of a company by discounting future cash flows.

- Merger Model Templates: Analyze the financial impact of a merger or acquisition.

- LBO Model Templates: Determine the maximum purchase price for a leveraged buyout.

4. Mastering Key Financial Modelling Concepts

4.1. Financial Statement Analysis

Understanding financial statements is fundamental to financial modelling. You need to be able to interpret and analyze the income statement, balance sheet, and cash flow statement.

- Income Statement: Reports a company’s financial performance over a period of time.

- Balance Sheet: Shows a company’s assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement: Tracks the movement of cash both into and out of a company over a period of time.

4.2. Valuation Techniques

Valuation techniques are essential for determining the intrinsic value of a company or asset.

- Discounted Cash Flow (DCF) Analysis: Estimates the value of a company by discounting future cash flows.

- Comparable Company Analysis (Comps): Values a company by comparing its financial metrics to those of its peers.

- Precedent Transactions Analysis: Estimates the value of a company based on recent M&A transactions.

4.3. Forecasting Methods

Forecasting methods are used to project future financial performance based on historical data and assumptions.

- Trend Analysis: Uses historical data to predict future trends.

- Regression Analysis: Analyzes the relationship between variables to forecast future values.

- Scenario Analysis: Evaluates the impact of different scenarios on financial performance.

4.4. Key Financial Ratios

Key financial ratios provide insights into a company’s financial health and performance.

- Profitability Ratios: Measure a company’s ability to generate profits.

- Liquidity Ratios: Assess a company’s ability to meet its short-term obligations.

- Solvency Ratios: Evaluate a company’s ability to meet its long-term obligations.

- Efficiency Ratios: Measure how efficiently a company uses its assets.

Table: Common Financial Ratios

| Ratio | Formula | Interpretation |

|---|---|---|

| Gross Profit Margin | (Revenue – Cost of Goods Sold) / Revenue | Measures the percentage of revenue remaining after subtracting the cost of goods sold, indicating how efficiently a company manages its production costs. |

| Net Profit Margin | Net Income / Revenue | Indicates the percentage of revenue that remains as net income after all expenses, reflecting overall profitability and operational efficiency. |

| Current Ratio | Current Assets / Current Liabilities | Assesses a company’s ability to cover its short-term liabilities with its current assets; a higher ratio indicates better liquidity. |

| Quick Ratio | (Current Assets – Inventory) / Current Liabilities | Similar to the current ratio but excludes inventory, providing a more conservative measure of short-term liquidity by focusing on more liquid assets. |

| Debt-to-Equity Ratio | Total Debt / Total Equity | Evaluates the proportion of a company’s financing that comes from debt versus equity, indicating financial leverage and risk. |

| Return on Equity | Net Income / Total Equity | Measures how effectively a company is using its equity to generate profits, reflecting the return to shareholders. |

| Asset Turnover Ratio | Revenue / Total Assets | Indicates how efficiently a company is using its assets to generate revenue; a higher ratio suggests better asset utilization. |

4.5. Accounting Principles

A solid understanding of accounting principles is essential for building accurate and reliable financial models.

- Generally Accepted Accounting Principles (GAAP): A set of accounting standards used in the United States.

- International Financial Reporting Standards (IFRS): A set of accounting standards used in many countries around the world.

5. Building Real-World Financial Models

5.1. Starting with Simple Models

Begin by building simple models to understand the basic concepts and techniques. A simple 3-statement model can be a great starting point.

- Step-by-Step Approach: Start with historical data, build the income statement, then the balance sheet, and finally the cash flow statement.

- Focus on Accuracy: Ensure your formulas are accurate and your assumptions are reasonable.

- Regularly Test Your Model: Check your model’s outputs against historical data to ensure accuracy.

5.2. Creating a 3-Statement Financial Model

A 3-statement model is the foundation of financial modelling. It integrates the income statement, balance sheet, and cash flow statement to provide a comprehensive view of a company’s financial performance.

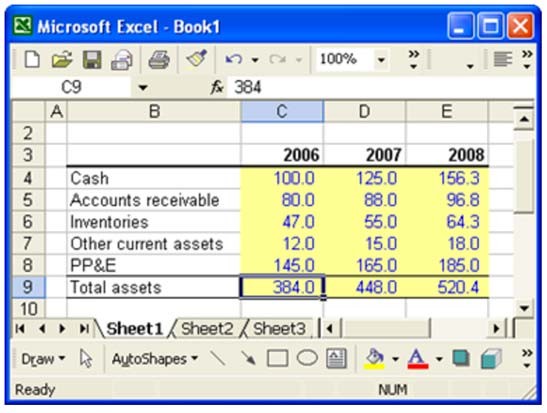

- Gather Historical Data: Collect historical financial data from a company’s annual reports (10-K) and quarterly reports (10-Q).

- Build the Income Statement: Forecast revenue, cost of goods sold, and operating expenses to project net income.

- Build the Balance Sheet: Project assets, liabilities, and equity based on historical trends and assumptions.

- Build the Cash Flow Statement: Use the direct or indirect method to project cash flows from operations, investing, and financing activities.

5.3. Developing a Discounted Cash Flow (DCF) Model

A DCF model estimates the intrinsic value of a company by discounting its future cash flows to their present value.

- Project Free Cash Flows: Forecast revenue, expenses, and capital expenditures to project free cash flows.

- Determine the Discount Rate: Calculate the weighted average cost of capital (WACC) to use as the discount rate.

- Calculate the Terminal Value: Estimate the value of the company beyond the forecast period using the Gordon Growth Model or the Exit Multiple Method.

- Discount Cash Flows: Discount the projected free cash flows and terminal value to their present value.

5.4. Practicing with Case Studies

Case studies provide real-world scenarios that allow you to apply your financial modelling skills and gain practical experience.

- Harvard Business School Case Studies: Offer a wide range of finance-related case studies.

- Corporate Finance Institute (CFI) Case Studies: Provide practical exercises and real-world examples.

- University Finance Courses: Often include case studies as part of the curriculum.

6. Advanced Financial Modelling Techniques

6.1. Scenario Analysis and Sensitivity Analysis

Scenario analysis and sensitivity analysis are used to assess the impact of different assumptions on a model’s outputs.

- Scenario Analysis: Evaluates the impact of different scenarios on financial performance.

- Sensitivity Analysis: Determines how changes in one variable affect the model’s outputs.

- Data Tables: Use Excel’s data tables to quickly assess the impact of changes in key assumptions.

- Monte Carlo Simulation: Use simulation tools to incorporate uncertainty and assess the range of possible outcomes.

6.2. Monte Carlo Simulation

Monte Carlo simulation is a powerful technique for incorporating uncertainty into financial models. It involves running thousands of simulations with randomly generated inputs to assess the range of possible outcomes.

- Identify Key Assumptions: Determine the assumptions that have the most significant impact on your model’s outputs.

- Define Probability Distributions: Assign probability distributions to each key assumption.

- Run Simulations: Use a simulation tool to run thousands of simulations with randomly generated inputs.

- Analyze Results: Analyze the simulation results to understand the range of possible outcomes and their probabilities.

6.3. Using VBA and Macros

VBA (Visual Basic for Applications) and macros can automate repetitive tasks and enhance the functionality of your financial models.

- Automate Repetitive Tasks: Use VBA to automate tasks such as data entry and formatting.

- Create Custom Functions: Develop custom functions to perform complex calculations.

- Enhance User Interface: Improve the user interface with custom forms and controls.

6.4. Integrating with Other Tools and Data Sources

Integrating financial models with other tools and data sources can improve their accuracy and efficiency.

- Bloomberg Terminal: Provides real-time financial data and analytics.

- Capital IQ: Offers comprehensive financial data and research.

- FactSet: Delivers integrated financial data and analytics.

- Database Integration: Connect your models to databases for seamless data retrieval.

6.5. Error Handling and Model Validation

Effective error handling and model validation are critical for ensuring the accuracy and reliability of your financial models.

- Implement Error Checks: Incorporate error checks to identify and prevent errors.

- Use Auditing Tools: Utilize Excel’s auditing tools to trace formulas and identify potential issues.

- Validate Model Outputs: Compare your model’s outputs against historical data and industry benchmarks.

- Stress Test Your Model: Test your model under different scenarios to identify potential weaknesses.

6.6. Best Practices for Financial Modelling

Following best practices for financial modelling can improve the transparency, accuracy, and usability of your models. According to research from the University of Waterloo, adhering to best practices can reduce errors and improve decision-making.

- Use Clear and Consistent Formatting: Use consistent formatting to improve readability and make it easier to understand the model.

- Document Your Assumptions: Clearly document your assumptions and the rationale behind them.

- Separate Inputs from Calculations: Keep inputs separate from calculations to make it easier to modify assumptions and audit the model.

- Use Formulas Instead of Hard-Coded Numbers: Use formulas instead of hard-coded numbers to ensure accuracy and consistency.

- Keep Your Model Simple and Transparent: Avoid unnecessary complexity and make sure your model is easy to understand.

6.7. Improving Financial Model Transparency

Enhancing financial model transparency is essential for ensuring that stakeholders can understand and trust the model’s results.

- Color Coding: Use color coding to differentiate between inputs, calculations, and outputs.

- Comments and Explanations: Add comments and explanations to clarify complex formulas and assumptions.

- Clear Layout: Organize your model with a clear and logical layout.

- Table of Contents: Include a table of contents to help users navigate the model.

- Executive Summary: Provide an executive summary that highlights the key findings and conclusions.

Table: Color Coding Guidelines for Financial Modeling

| Cell Type | Formula Example | Color Code | Purpose |

|---|---|---|---|

| Hard-coded Numbers (Inputs) | =1234 |

Blue | Indicates cells where users should enter data, making it easy to identify and modify key assumptions. |

| Formulas (Calculations) | =A1*A2 |

Black | Signifies cells containing formulas, ensuring that users avoid accidentally overwriting calculations and understand the logic behind the model. |

| Links to Other Worksheets | =Sheet2!A1 |

Green | Highlights links to other worksheets within the same file, aiding in tracing dependencies and understanding the model’s structure. |

| Links to Other Files | =[Book2]Sheet1!$A$1 |

Red | Alerts users to links to external files, ensuring they are aware of external dependencies and can verify the data source. |

| Links to Data Providers (e.g., CIQ) | =CIQ(IQ_TOTAL_REV) |

Dark Red | Identifies data sourced from external providers, allowing users to quickly verify the data’s accuracy and relevance. |

7. Staying Updated with Industry Trends

7.1. Following Industry Publications and Blogs

Staying updated with industry trends is crucial for maintaining your financial modelling skills and knowledge.

- The Wall Street Journal: Provides news and insights on finance, economics, and business.

- Bloomberg: Offers real-time financial data, news, and analytics.

- Financial Times: Delivers global business and financial news.

- Seeking Alpha: Provides investment research and analysis from contributors.

7.2. Participating in Webinars and Conferences

Participating in webinars and conferences can help you learn from industry experts and network with other professionals.

- Financial Modelling World Cup: An annual competition that tests financial modelling skills.

- CFA Institute Conferences: Offer professional development and networking opportunities.

- AIM Investment Conferences: Provide insights into investment strategies and trends.

- LEARNS.EDU.VN: Access to webinars and online events featuring leaders in education.

7.3. Continuous Learning and Development

Financial modelling is a constantly evolving field, so continuous learning and development are essential.

- Pursue Certifications: Earn certifications such as the Chartered Financial Analyst (CFA) designation or the Financial Modeling & Valuation Analyst (FMVA) certification.

- Take Advanced Courses: Take advanced courses on topics such as machine learning and artificial intelligence in finance.

- Stay Curious: Continuously explore new tools, techniques, and industry trends.

7.4. Incorporating AI and Machine Learning in Financial Modelling

The integration of artificial intelligence (AI) and machine learning (ML) is revolutionizing financial modelling, offering enhanced capabilities in forecasting, risk management, and decision-making. Incorporating these technologies can lead to more accurate and efficient models, providing a competitive edge in the financial industry.

- Enhanced Forecasting:

- Time Series Analysis: ML algorithms can analyze extensive historical data to identify complex patterns and trends, improving the accuracy of financial forecasts. Tools like ARIMA, Exponential Smoothing, and Recurrent Neural Networks (RNNs) are particularly effective.

- Predictive Analytics: ML models can predict future financial outcomes by considering a wide range of variables and their interactions, offering a more comprehensive view than traditional statistical methods.

- Improved Risk Management:

- Credit Risk Assessment: ML algorithms can assess credit risk more accurately by analyzing a combination of financial and non-financial data, such as credit scores, transaction history, and macroeconomic indicators.

- Fraud Detection: AI-powered systems can detect fraudulent activities in real-time by identifying unusual patterns and anomalies in financial transactions.

- Efficient Decision-Making:

- Algorithmic Trading: AI algorithms can execute trades automatically based on predefined rules and market conditions, optimizing trading strategies and reducing human error.

- Portfolio Optimization: ML models can analyze vast datasets to optimize investment portfolios, balancing risk and return to meet specific financial goals.

Table: AI and Machine Learning Techniques in Financial Modelling

| Technique | Description | Application |

|---|---|---|

| Time Series Analysis | Uses historical data to predict future values based on identified patterns. | Forecasting stock prices, revenue, and other financial metrics. |

| Regression Analysis | Analyzes the relationship between variables to forecast future values. | Predicting sales based on marketing spend, interest rates, and other economic factors. |

| Neural Networks | Employs interconnected nodes (neurons) to recognize patterns and make predictions. | Credit risk assessment, fraud detection, and algorithmic trading. |

| Clustering | Groups similar data points together to identify patterns and segments. | Customer segmentation, market research, and portfolio diversification. |

| Natural Language Processing (NLP) | Enables computers to understand and process human language. | Sentiment analysis of news articles and social media to inform investment decisions. |

| Robotic Process Automation (RPA) | Automates repetitive tasks by mimicking human actions. | Automating data entry, report generation, and other routine tasks in financial modeling. |

| Machine Learning as a Service (MLaaS) | Provides cloud-based ML tools and services that enable users to develop and deploy ML models without extensive programming skills. | Developing and deploying predictive models for financial forecasting, risk management, and investment analysis. |

By learning financial modelling and incorporating the power of AI and machine learning, you’re not just mastering a skill; you’re equipping yourself with the tools to lead in the financial world. Whether it’s forecasting market trends or optimizing investment strategies, the ability to blend traditional finance with cutting-edge technology is your key to success.

8. Building a Professional Network

8.1. Joining Professional Organizations

Joining professional organizations can provide valuable networking opportunities and access to resources and events.

- CFA Institute: A global association for investment professionals.

- Financial Management Association (FMA): An organization for finance professionals and academics.

- Association for Financial Professionals (AFP): A professional society for treasury and finance professionals.

8.2. Attending Industry Events

Attending industry events can help you network with other professionals and learn about the latest trends and developments.

- Financial Modelling World Cup: An annual competition that tests financial modelling skills.

- CFA Institute Conferences: Offer professional development and networking opportunities.

- AIM Investment Conferences: Provide insights into investment strategies and trends.

8.3. Networking Online

Networking online can help you connect with professionals from around the world and stay updated with industry news and events.

- LinkedIn: A professional networking platform with millions of users.

- Twitter: A social media platform for sharing news and insights.

- Forums and Discussion Boards: Online communities where professionals can share knowledge and ask questions.

8.4. Mentorship and Guidance

Seeking mentorship and guidance from experienced professionals can accelerate your learning and provide valuable insights.

- Find a Mentor: Look for experienced professionals who can provide guidance and support.

- Attend Networking Events: Attend industry events to meet potential mentors.

- Join Online Communities: Participate in online communities and connect with experienced professionals.

- LEARNS.EDU.VN: Connects you with mentors and experts to guide you through your educational journey.

Contact Information: For further inquiries, reach out to us at 123 Education Way, Learnville, CA 90210, United States. Whatsapp: +1 555-555-1212. Website: LEARNS.EDU.VN.

9. FAQs: Learn Financial Modelling

9.1. What Prerequisites Do I Need Before Learning Financial Modelling?

Basic knowledge of finance and accounting is helpful, along with proficiency in Excel. Familiarity with financial statements and key financial ratios is also beneficial.

9.2. How Long Does It Take to Become Proficient in Financial Modelling?

Proficiency varies, but a solid understanding can be achieved in a few months with consistent practice. Mastering advanced techniques may take several years.

9.3. Is Financial Modelling a Good Career?

Yes, financial modelling is a rewarding career with high demand in finance, investment banking, and corporate strategy.

9.4. Can I Learn Financial Modelling Online?

Yes, numerous online courses and tutorials are available. Platforms like Coursera, Udemy, and LinkedIn Learning offer comprehensive courses.

9.5. What Are the Most Important Excel Functions for Financial Modelling?

Key functions include SUM, AVERAGE, IF, VLOOKUP, HLOOKUP, NPV, IRR, and XNPV.

9.6. What Is the Difference Between Scenario Analysis and Sensitivity Analysis?

Scenario analysis evaluates the impact of different scenarios, while sensitivity analysis determines how changes in one variable affect the model’s outputs.

9.7. How Can I Validate a Financial Model?

Validate your model by comparing its outputs against historical data, using auditing tools, and stress-testing it under different scenarios.

9.8. What Are the Common Mistakes to Avoid in Financial Modelling?

Avoid hard-coding numbers, using complex formulas, and failing to document assumptions.

9.9. How Can I Stay Updated with Industry Trends in Financial Modelling?

Follow industry publications, participate in webinars and conferences, and continuously learn and develop your skills.

9.10. Is a Certification Necessary to Work in Financial Modelling?

While not always required, certifications like the CFA or FMVA can enhance your credibility and career prospects.

10. Conclusion

Learning financial modelling requires dedication, practice, and a strategic approach. By identifying your learning style, choosing the right tools and resources, mastering key concepts, building real-world models, and staying updated with industry trends, you can develop the skills needed to excel in this dynamic field. Ready to take your financial modelling skills to the next level? Visit LEARNS.EDU.VN today to explore our comprehensive resources and courses. Whether you’re looking to build a solid foundation or master advanced techniques, LEARNS.EDU.VN provides the tools and support you need to achieve your learning goals. Unlock your potential and transform your career with the power of financial modelling. Discover the wealth of knowledge and opportunities that await you at LEARNS.EDU.VN.

Financial modeling requires an understanding of historical financial data, operating drivers, and market data

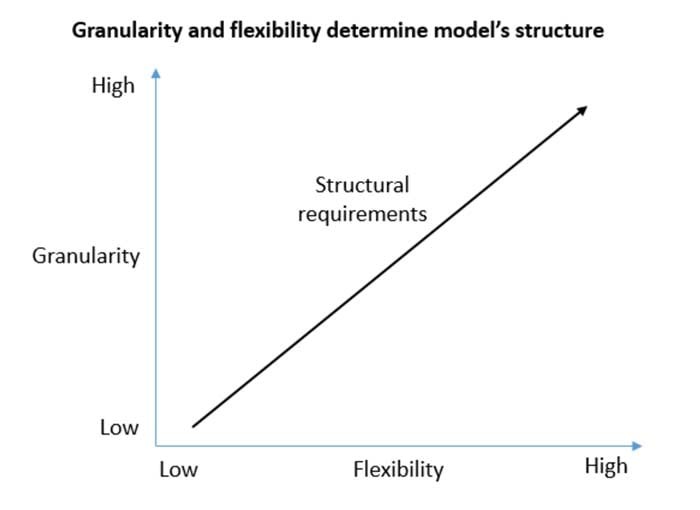

The table shows the granularity and flexibility levels of common investment banking models.

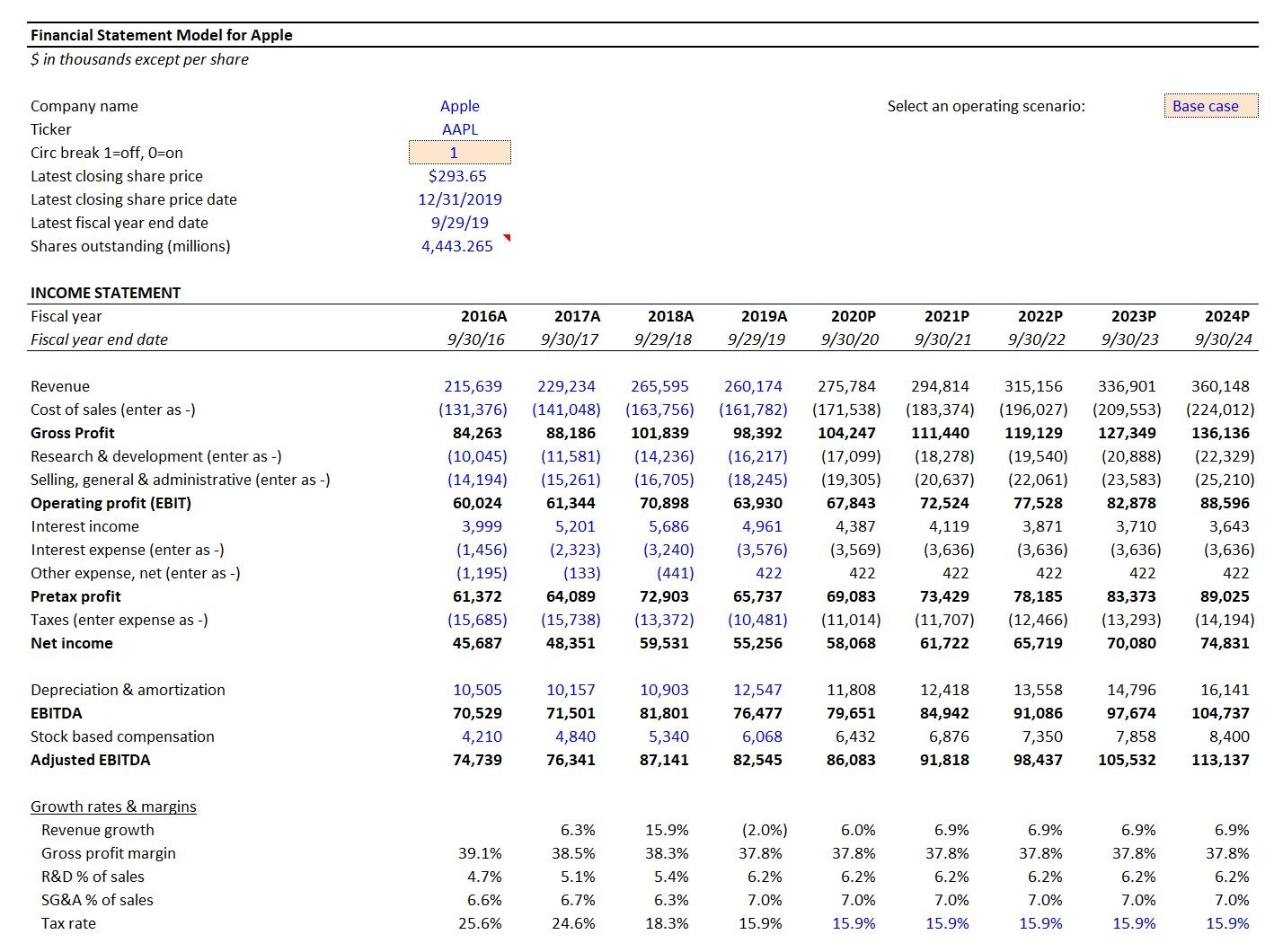

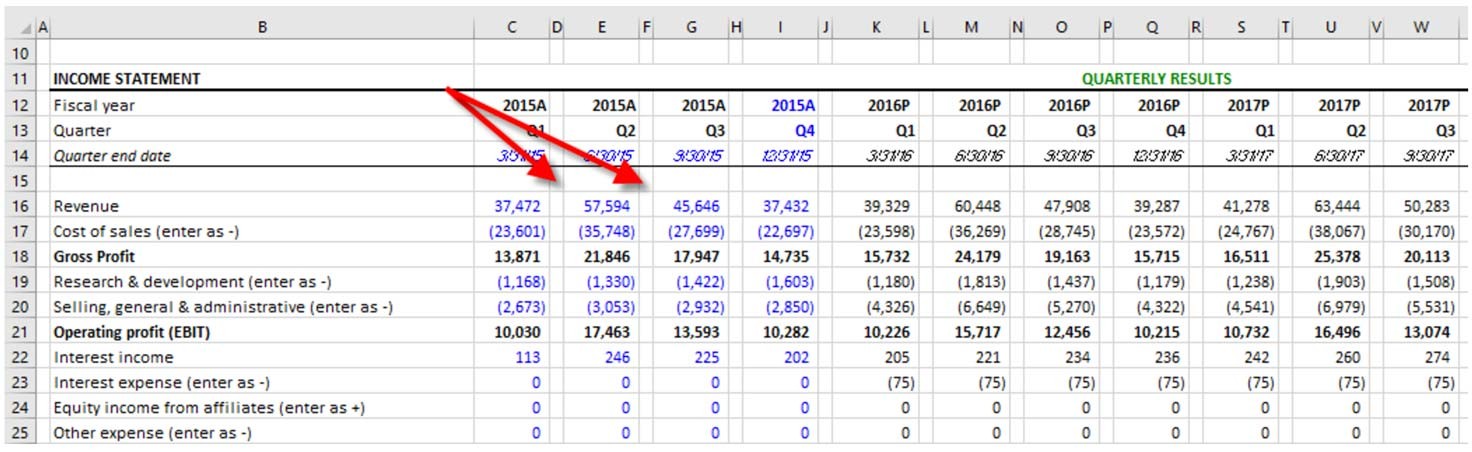

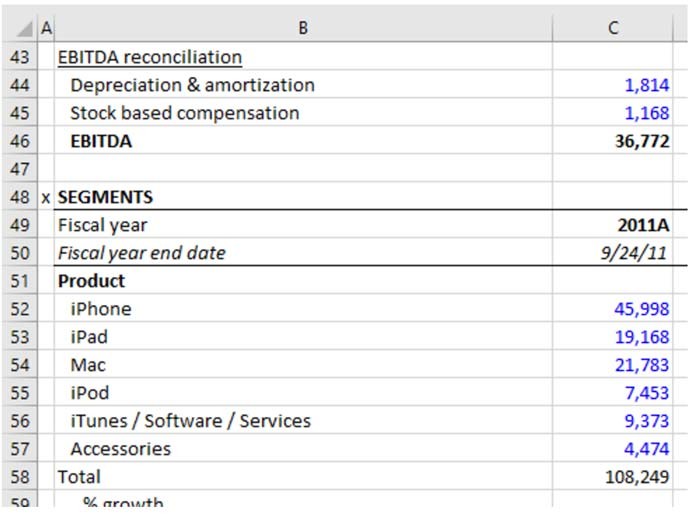

Financial Modeling Example – Apple 3-Statement Model (Source: WSP Financial Modeling Course)

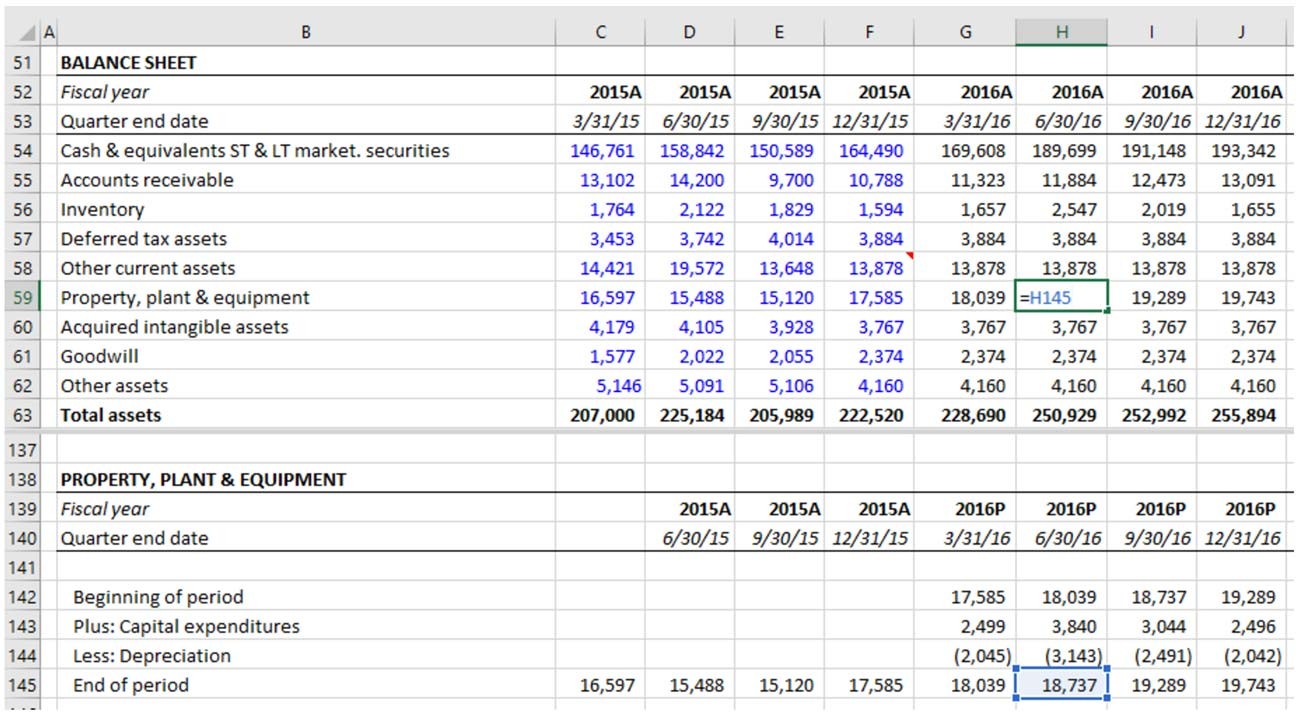

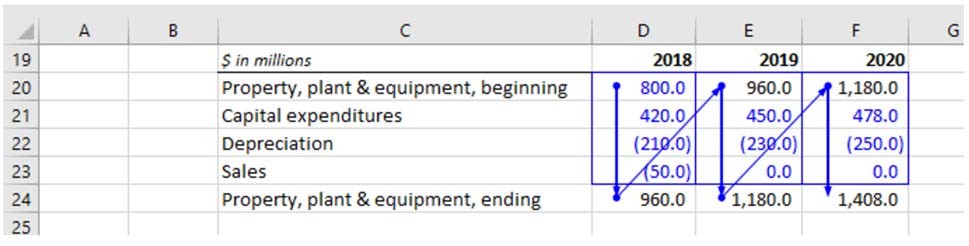

Balance sheet forecasts should be determined in separate schedules and linked to the balance sheet, as illustrated below.

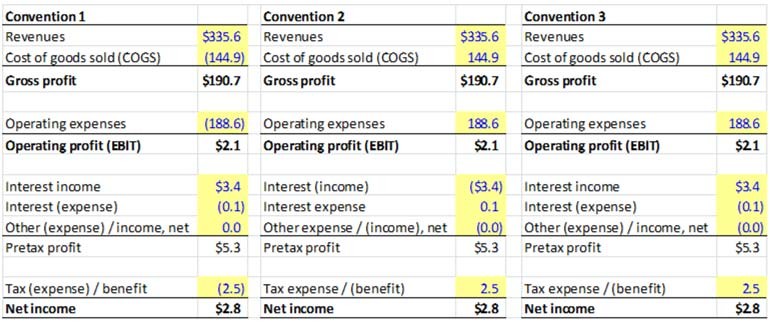

Choose from and clearly identify one of the following 3 approaches.

Never Re-Enter the Same Input in Different Cells

Maintaining strict adherence to the roll-forward approach improves a user’s ability to audit the model and reduces the likelihood of linking errors.

No Spacer Columns Between Data

Elevator Jumps

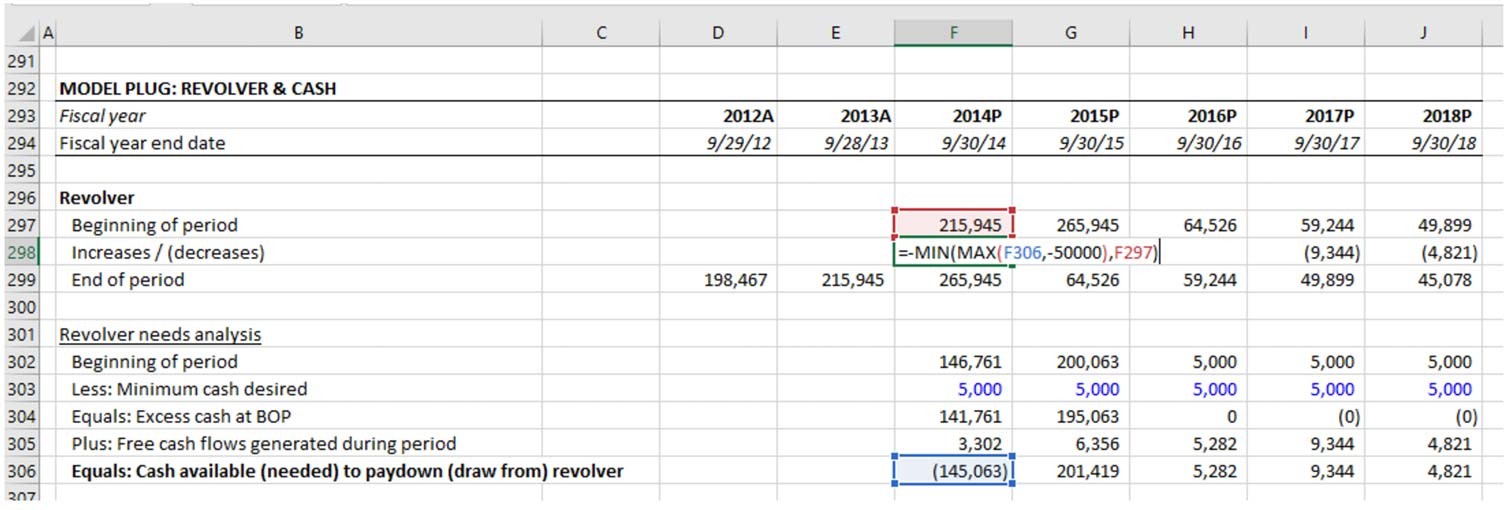

Revolver Formula

Don’t let complex financial concepts hold you back. Visit learns.edu.vn today and start your journey toward financial expertise. Our resources and expert guidance will help you navigate the intricacies of financial modelling with confidence.