The learning technology landscape is rapidly changing, and at the forefront of this evolution is the Learning Experience Platform (LXP). Just a few years ago, the concept of an LXP was nascent, championed by startups like Pathgather, Degreed, and EdCast, who envisioned platforms that would revolutionize corporate learning content discovery. These pioneering platforms quickly gained traction, prompting many organizations to reconsider the traditional Learning Management System (LMS).

Since then, the LXP market has experienced explosive growth, now valued at over $300 million and expanding at an impressive rate of 50% annually. This growth, however, brings with it new challenges and complexities. The market is maturing, vendors are expanding their offerings, and the direction of product development is diversifying.

A key question emerges: Will LXPs ultimately replace the established LMS market, which is valued at over $4 billion? The answer, according to industry experts, is increasingly leaning towards yes. This shift is evident in the fact that every major LMS vendor is now actively investing and developing solutions within the LXP space.

The Genesis of Learning Experience Platforms: Addressing the Discovery Challenge

The fundamental need that LXPs address is discovery. In essence, LXPs emerged to solve a critical problem:

“I want to learn something new or find a relevant course, but I simply cannot locate it within the overwhelming and often cumbersome course catalog of our LMS.”

Traditional LMSs were not designed with the employee, the learner, in mind. They were conceived as “Management” systems for learning, prioritizing business rules, compliance mandates, and the administrative management of course catalogs. This often resulted in a disjointed and frustrating learner experience.

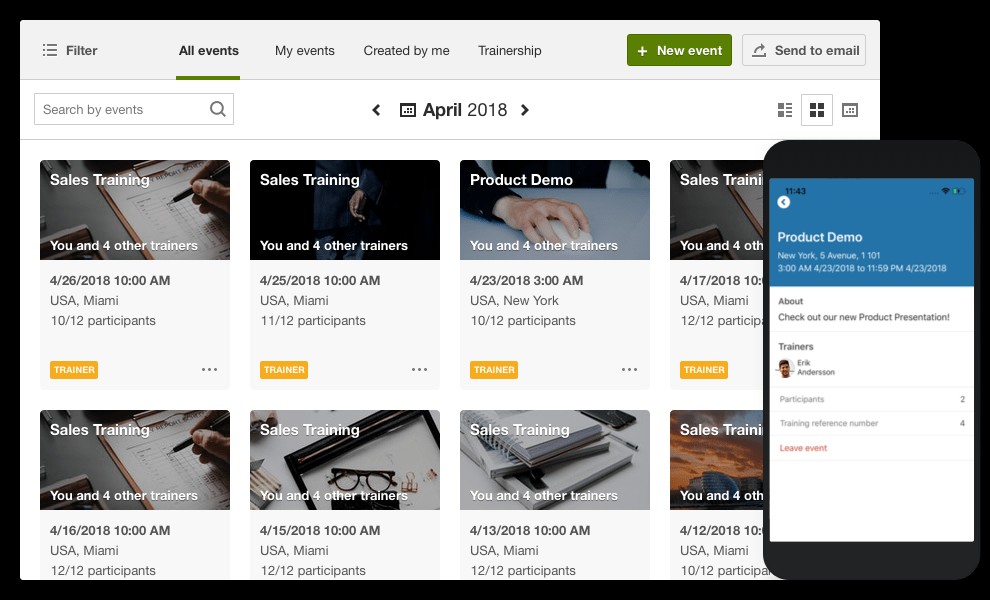

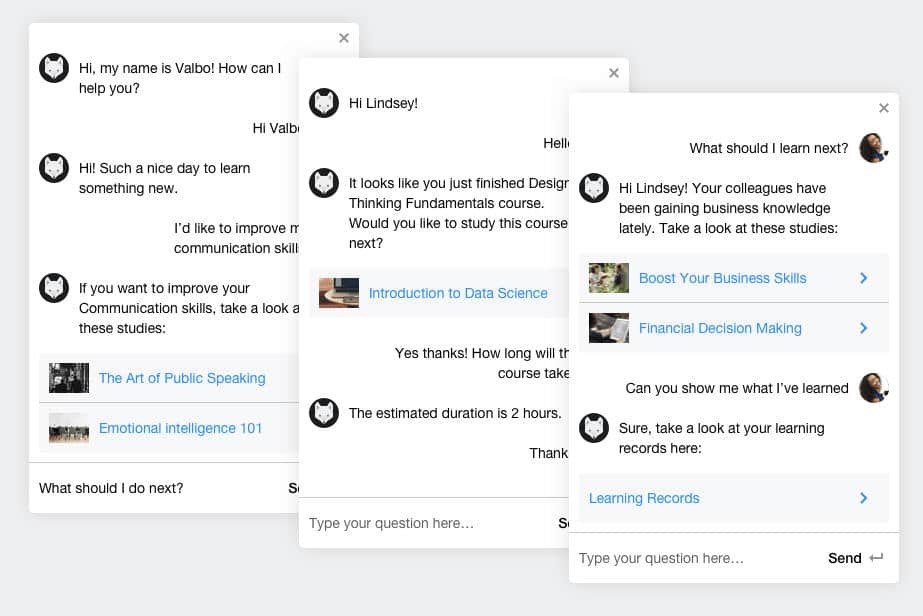

LXPs, in contrast, are built from the ground up as content delivery systems, mirroring the user-friendly interfaces of platforms like YouTube or Netflix. They prioritize ease of content discovery and consumption, offering a more intuitive and engaging learner experience.

| Fig 1: A Typical LXP Interface Emphasizing User-Friendly Content Discovery |

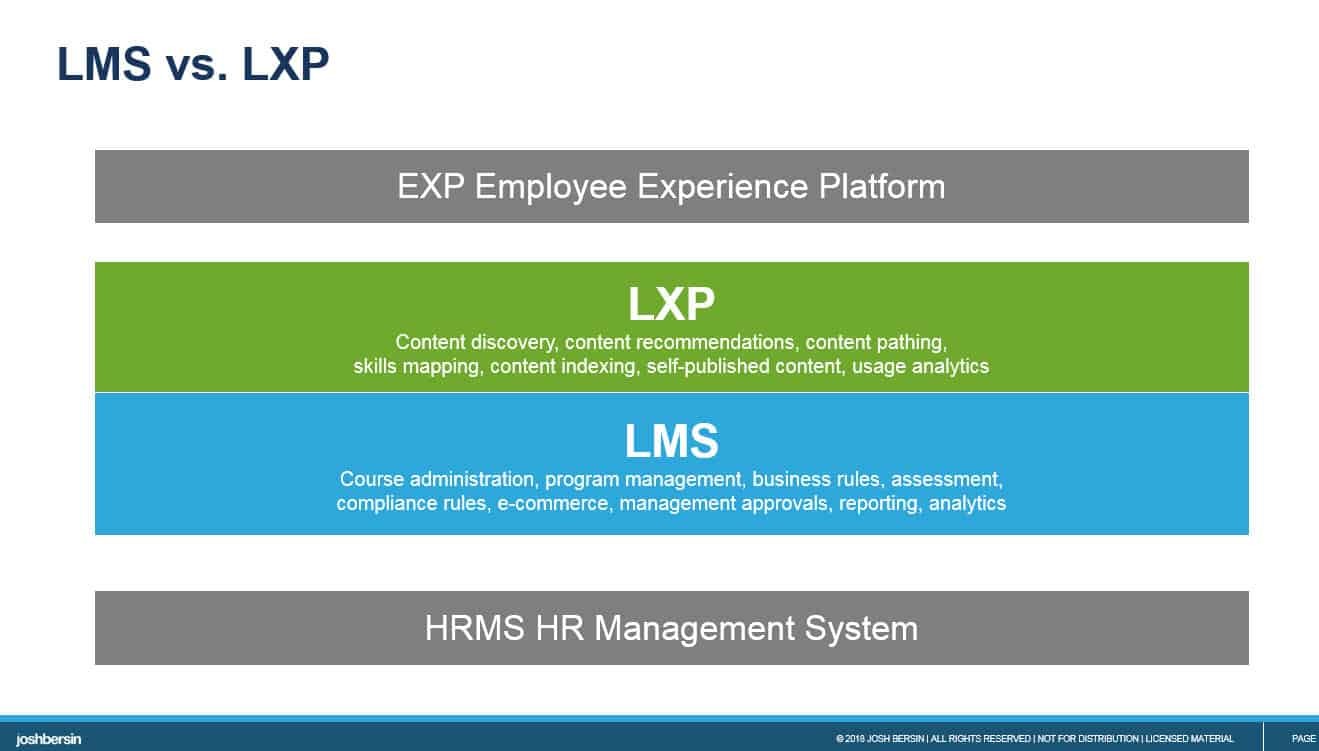

While both LMS and LXP systems serve distinct purposes, the lines between them are becoming increasingly blurred. To simplify the distinction, consider the visual representation below.

| Fig 2: Contrasting the Traditional LMS and the Modern LXP Ecosystem |

In the early stages of LXP development, their functionality was relatively limited, primarily focusing on content aggregation. They acted as portals, bringing together learning resources in a more accessible way.

However, as the LXP category has matured, so has its functionality. Beyond intelligent content recommendation, LXPs are now capable of recommending external articles, identifying internal subject matter experts, and indexing a wide range of digital assets, including documents and videos. This evolution positions LXPs as a convergence of content management, knowledge management, and learning systems, driving the rapid market growth.

The Intricacies of Content Discovery: A Complex Challenge

The core challenge that LXPs tackle – discovery – is inherently complex. This complexity is what propelled Google to become a global giant. Within organizations, employees often need to navigate thousands of learning resources. As companies create more content, especially with user-friendly tools like 360Learning, the learning library expands exponentially. Moreover, LXPs increasingly tap into the vast resources of the internet, where countless videos, articles, podcasts, and webpages offer potential learning opportunities.

As the founder of EdCast aptly stated, the true mission of an LXP is to “index the world of learning,” simplifying the process of finding precisely what a learner needs. This ambitious goal, often likened to creating “The Google of Learning,” is far more challenging in practice than in theory.

Early adopters of LXPs often express initial enthusiasm for these platforms. However, as content accumulates, the challenge of “intelligent discovery” becomes more pronounced. This is the critical area where the LXP market is currently focusing its innovation and development efforts to enhance the learner experience.

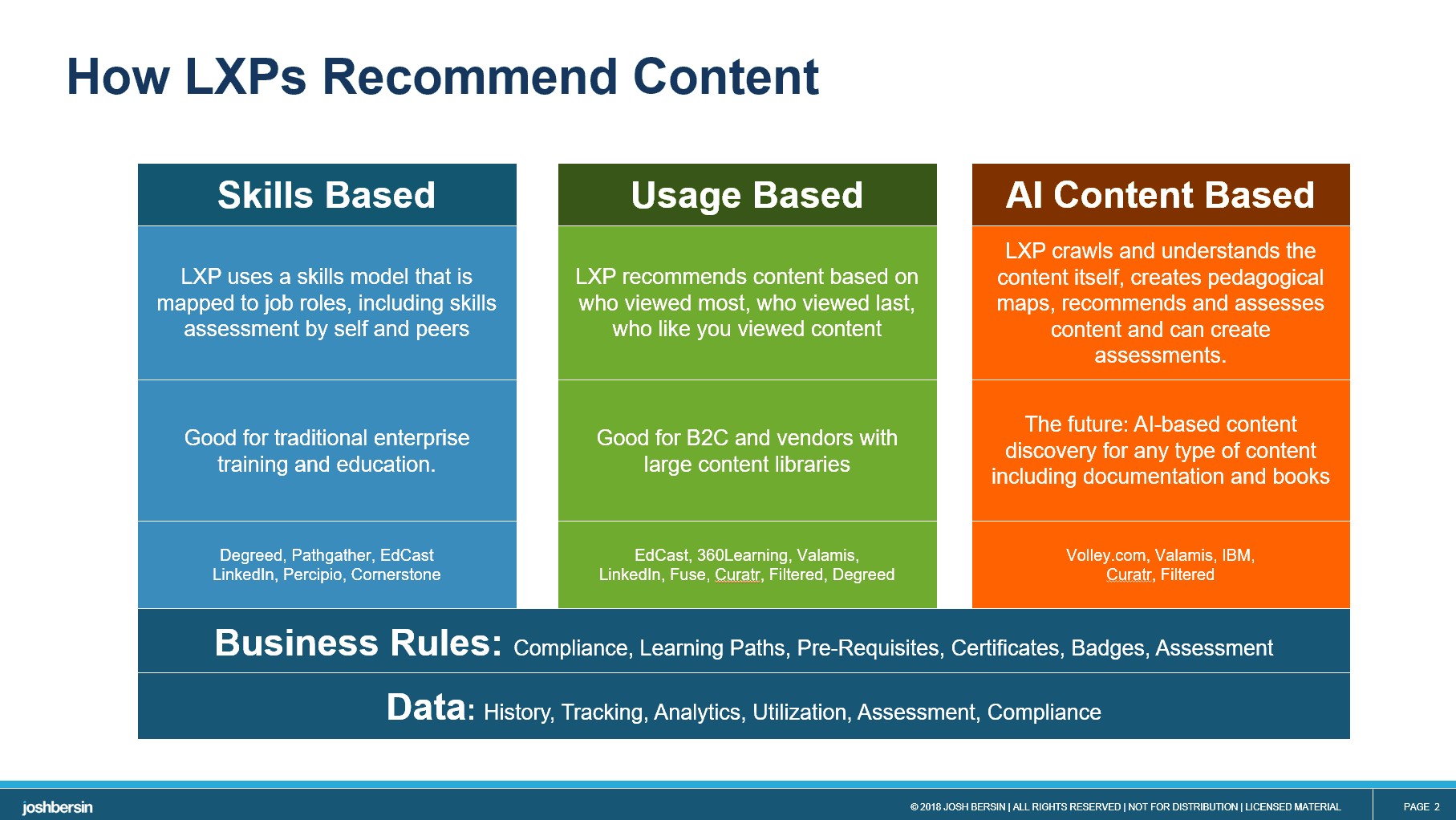

The Six Dimensions of Content Discovery Evolution in LXPs

The LXP market is evolving rapidly, with content discovery strategies advancing along six key dimensions simultaneously.

| Fig 3: Six Key Approaches to Content Recommendation within LXPs |

1. Skills-Based Learning:

Leading LXP vendors like Degreed, LinkedIn Learning, EdCast, Percipio, and IBM are integrating skills-based discovery tools into their platforms. While most LXPs already incorporate skills-based tagging, these vendors are now developing more sophisticated features, including skills assessments, skills inference capabilities, and skills-based learning pathways. The demand for skills-based learning has always been strong, but its implementation is complex.

IBM’s Watson Talent Frameworks, for example, represents one of the most comprehensive skills frameworks globally, encompassing over 3,000 job profiles and 2,000 integrated skills. LXPs aiming to map content to such extensive skills frameworks face a significant undertaking. Degreed has launched its own internal skills assessment engine, and similar developments are anticipated from other vendors.

Pluralsight, a prominent provider of technical skills training, has developed Skill IQ, an innovative skills assessment engine within its learning portal. Acquired from Smarterer, Skill IQ leverages crowdsourced assessment methodologies. While Pluralsight is not directly in the LXP market, it raises the question of how LXPs can effectively utilize skills data from content providers to improve the learner experience.

2. Usage-Based Recommendations:

Vendors such as EdCast, SkillSoft, Cornerstone, LinkedIn Learning, and Fuse utilize aggregated user data to drive learning recommendations based on the consumption patterns of others. While conceptually similar to Google’s PageRank or Facebook’s EdgeRank, this approach presents challenges. Highly consumed content can become over-recommended, potentially overshadowing valuable but less popular resources. Furthermore, relevance can be geographically and contextually dependent. Should an employee in Paris see content that is most popular in China?

While usage-based recommendations hold promise, refining their accuracy and relevance requires significant research and development. There have been instances of LXPs recommending irrelevant public internet content simply due to high traffic volume. Despite these challenges, vendors are continually developing smarter recommendation engines.

EdCast’s work with NASSCOM and other major institutions focused on enhancing machine learning recommendations. Degreed, Valamis, and CrossKnowledge are also employing client-specific machine learning models. Degreed’s partnership with Harvard Publishing aims to leverage usage patterns of Harvard content to refine recommendations. Wiley, the parent company of CrossKnowledge and a major publisher, is investing in data lake projects to improve content recommendations.

Fuse offers a nuanced approach by allowing teams to segment themselves into communities, enabling the system to recommend content that is most popular and relevant within specific groups. Clients have found this more targeted approach to be significantly more effective than enterprise-wide usage tracking, enhancing the learner experience by providing more pertinent recommendations.

3. AI-Based Content Analysis:

A more advanced approach to content discovery involves AI-driven content analysis. Vendors like Volley.com (a leader in this area), Valamis, IBM, and Docebo are developing systems that ingest instructional content (text, video, audio) and identify the core instructional elements within.

These systems essentially “read” the content to understand its learning objectives and target audience.

Volley.com, widely adopted in the financial sector, can analyze cybersecurity documentation and automatically generate training modules, microlearning assets, and assessments on security procedures. This approach has immense potential as these systems can assess content’s level of expertise and credibility through pedagogical analysis, leading to a more refined and effective learner experience.

| |

||

IBM and Valamis’s learning platforms also incorporate content analysis capabilities. Valamis, used by Boeing, can pinpoint specific segments within videos that are most relevant to a learner’s needs. Content analysis is poised to become a major area of innovation in the LXP market.

4. Conversational Learner Interaction:

Another approach focuses on direct interaction with the learner through conversational interfaces.

Ideally, a learning platform should understand a learner’s role, experience, learning history, preferences, aspirations, and goals.

Most LXPs allow users to specify their interests upon login. However, a more comprehensive understanding requires considering factors like tenure, aspirations, expertise levels, and learning styles. Some learners prefer reading, while others prefer podcasts or videos.

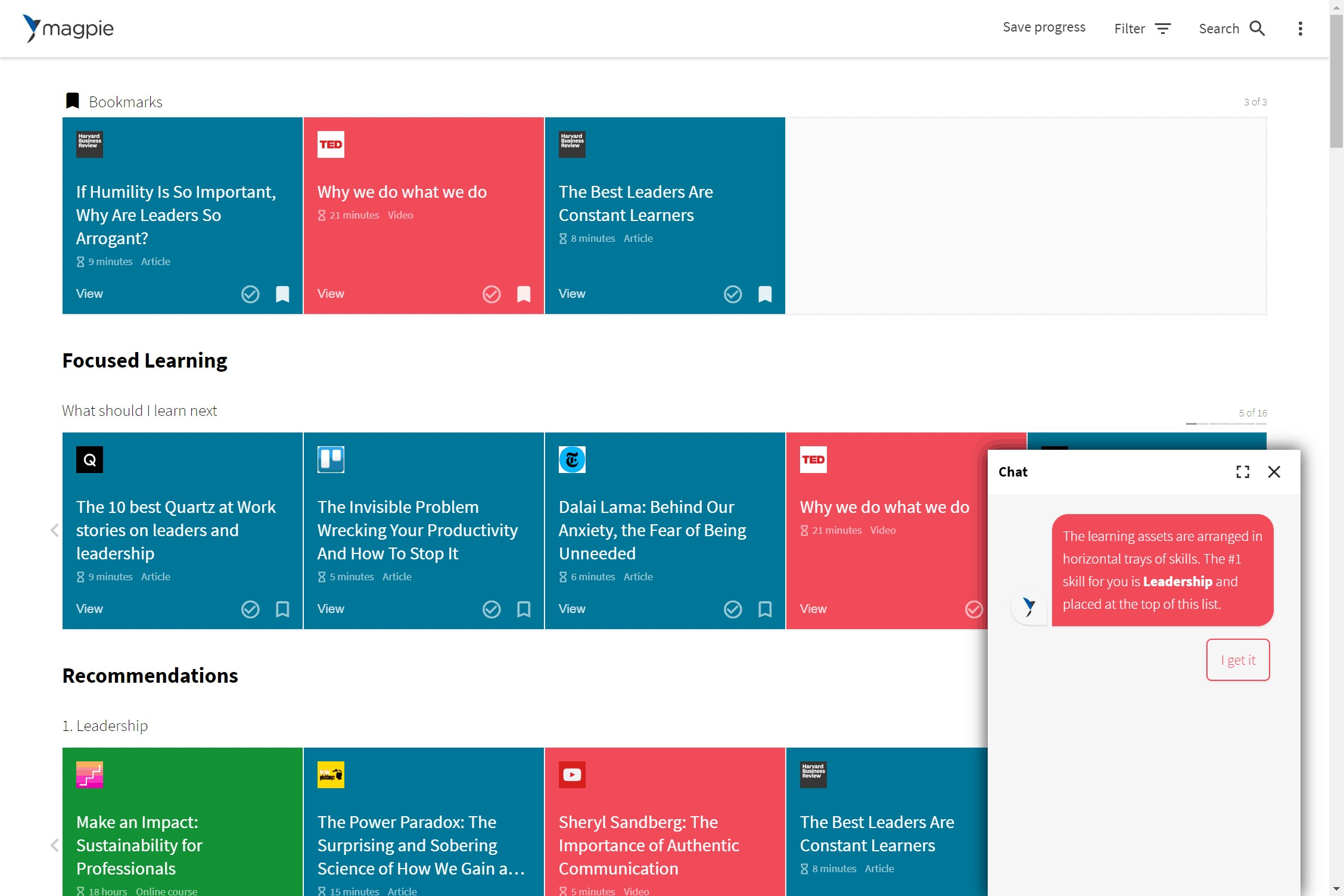

LinkedIn Learning has significant potential in this area. Companies like Filtered, Degreed, and Valamis are also actively developing solutions to personalize recommendations through learner interaction. Degreed has collaborated with Bank of America to map specific job roles to relevant learning recommendations. IBM’s YourLearning platform leverages Watson Talent Frameworks for similar personalization. Filtered’s Magpie product uses a question-driven onboarding process to understand a user’s role, interests, learning needs, and skills profile to provide tailored recommendations, significantly improving the learner experience.

| Fig 4: Personalized Recommendations Powered by Filtered’s Magpie |

5. Expanding Learning Business Rules:

A more conventional but essential approach involves integrating “business rules for learning” into LXPs. LMSs have traditionally managed these rules.

Examples of business rules include mandatory compliance training, new hire onboarding programs, and required recertifications.

These business rules, previously confined to LMSs, are increasingly being incorporated into LXPs. As LXPs become repositories for vast amounts of content, extending their capabilities to formalize, recommend, track, and manage curricula and programs becomes logical. While this represents a significant undertaking for LXP vendors, it is a necessary step in the evolution of these platforms to provide a more comprehensive learner experience.

(Valamis’s Digital Learning Assistant exemplifies the use of conversational interfaces to manage these business rules.)

| Fig 5: Valamis’s Digital Learning Assistant for Enhanced Learning Management |

6. Data Storage and Analytics:

The sixth dimension is data management. Where will learning data, including utilization, history, tracking, assessment, and compliance information, be stored? Currently, many organizations deploy LXPs as front-end interfaces to their existing LMSs. However, the question arises: “Why maintain two separate platforms?” Can LXPs store data within the LMS, or can a single, integrated system suffice?

Currently, LXPs typically do not store extensive learning history data, but they are collecting a growing amount of valuable information. Organizations must strategically decide where to store this data and how to leverage it effectively for machine learning and analytics to further enhance the learner experience.

The Future of Learning Business Rules: LXP or LMS?

A key unresolved question is the future location of learning business rules.

Examples of Learning Business Rules:

- Compliance: Mandatory content with completion tracking and recertification requirements.

- Career Programs: Onboarding, new hire training, and career development tracks with prerequisites and assessments.

- Customer Education: Paid courses, content licensing restrictions, e-commerce, training credits, and discounts.

- Performance Support: Content search for immediate answers and just-in-time learning.

- Development Plans: Storage and tracking of personalized development plans created after performance reviews.

- Manager Approval: Course approval workflows and manager visibility into employee learning progress.

- Ad-Hoc Learning: System-driven nudges for relevant or adjacent learning content.

- Learning in the Flow of Work: Integration of learning content directly into daily workflows.

While LMSs traditionally manage much of this functionality, this paradigm is likely to shift. Over time, core HR systems may incorporate more of these functionalities (as seen in Workday’s strategy), positioning the LXP as an increasingly central and critical component of the learning technology architecture.

Will LXPs Evolve into the New LMS?

LMS vendors often downplay the complexity of LXP development, with some even considering LXPs as easily replicable features.

However, the reality may be the opposite. LXPs are emerging as the future of learning delivery platforms, attracting significant and growing investment. Legacy LMS vendors are striving to adapt and integrate LXP functionalities, but they are encountering substantial challenges.

As an IBM veteran once noted, “It’s hard to make old software do new tricks. Software is hard, but hardware is soft.”

Transforming legacy LMSs into modern, agile LXPs is not a simple task. Many vendors are finding that a complete rebuild is necessary (as Skillsoft has done with Percipio). Acquisitions within the market, with LXP vendors potentially acquiring LMS vendors, are anticipated.

The Economic Imperative: LXP Value Proposition

The economics of the LXP market are a crucial consideration.

As the LXP market expands in value and influence, training departments must strategically allocate their budgets. Some organizations, early adopters of LXPs, are considering replacing their standalone LXPs with integrated solutions offered by their existing LMS vendors, primarily to consolidate costs.

Conversely, there is growing pressure to reduce LMS spending. Several global enterprises are planning to decommission their LMSs in the coming years, signaling a significant shift in market dynamics.

The LXP market is dynamic, innovative, and rapidly evolving. Organizations navigating the LXP landscape or seeking guidance in this area should seek expert consultation to make informed decisions and optimize their learner experience strategies.